They say, “fashion is always changing,” and the beauty industry is just as volatile. Keeping up on the newest trends takes passion and requires careful attention for millions the world over. Nowhere is that truer than among ShareThis’ U.S. audiences, where the changes that can happen in just a short time can be surprising.

Glow in the Dark Day

“You’re glowing” seems to be a phrase on people’s minds because “glow,” “glowy,” and “glowing” are the words people are looking for most when searching for anything related to beauty, ahead of buzzwords radiant, dewy, and matte. With 7.6x the average engagement volume, ShareThis beauty audiences don’t want to just shine, they want to glow! The trend has shifted from big makeup looks to the no-makeup makeup look, or “Zoom appearance.” When we are on camera and rarely leaving the house, we want to look fresh, awake, and effortless!

Keyword Engagement by Volume:

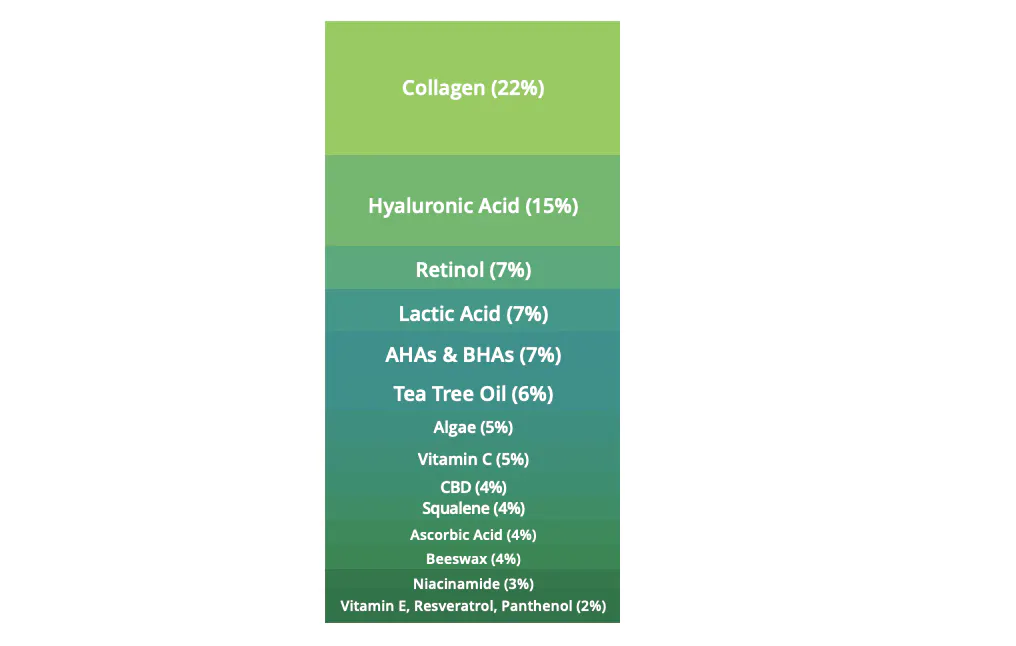

With this focus, it’s unsurprising that the ingredients audiences want in their products are collagen and hyaluronic acid, both of which are attributed to more youthful and healthy-looking skin. Hyaluronic acid, in particular, goes a long way in helping skin retain moisture—holding up to 1,000 times its molecular weight in water!—which is a huge boost when your goal is to look fresh and luminous. This pursuit of the “dewy” ideal and “mermaid skin” is also likely why algae is so high on the targeted ingredient list.

Top Ingredients by Percent Share of Engagement (%):

Great Skin is the Foundation of Beauty

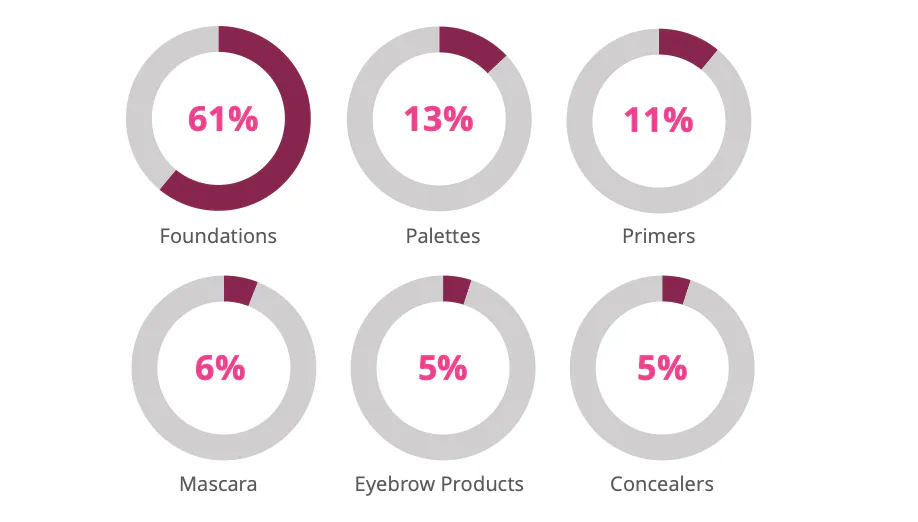

Taking a look at makeup products, it’s no surprise that foundations are by far the most searched and shared product among ShareThis makeup audiences with 61% of all engagement. After all, your foundation is what keeps it all looking fresh! Primers are also critical to enhancing makeup and getting that effortless glow, so it makes perfect sense that they’re within the top three too.

Top Searched & Shared Makeup Products by Percent Share of Engagement:

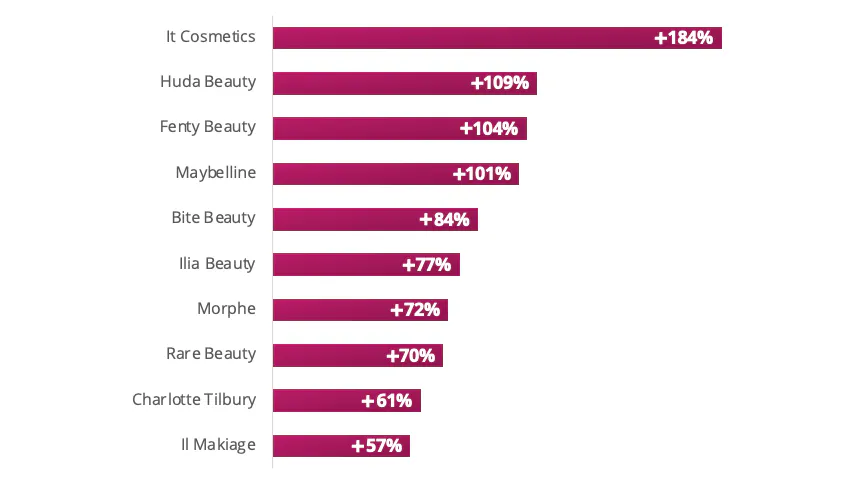

With this focus on creating the right base for that youthful look, IT Cosmetics is seeing staggering growth—184% growth month-over-month (MoM). This could be largely due to their products like tinted SPF moisturizers in various shades that are focused on delivering moisture, protecting your skin, and creating a fresh, youthful base. They were a pioneer in the BB (beauty balm) and CC (color correcting) multi-tasking products that are saturating the market today. We’re also seeing upticks in those brands that have big influencers behind them, such as Rihanna for Fenty, and those that are clean and science-focused, like Bite Beauty. This brings up the question: What drives more interest in the beauty world—influencers promoting a product or products rooted in science?

Fastest Growing Makeup Brands by Average Month-Over-Month Growth:

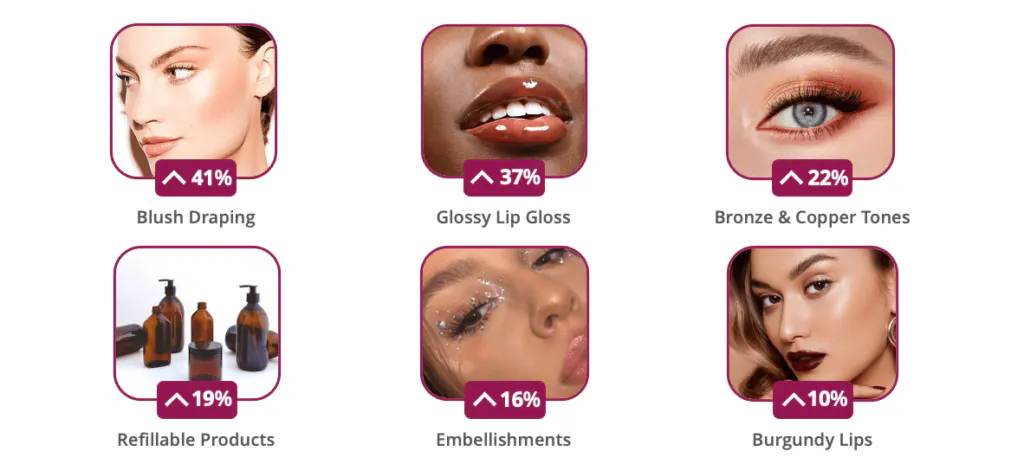

Meanwhile, the fastest-growing trends week-over-week (WoW) are blush draping and glossy lip gloss. But refillable products are trending as well, as ShareThis audiences look for more affordable and sustainable options for beauty.

Average Week-Over-Week Engagement Growth of Makeup Trends (%):

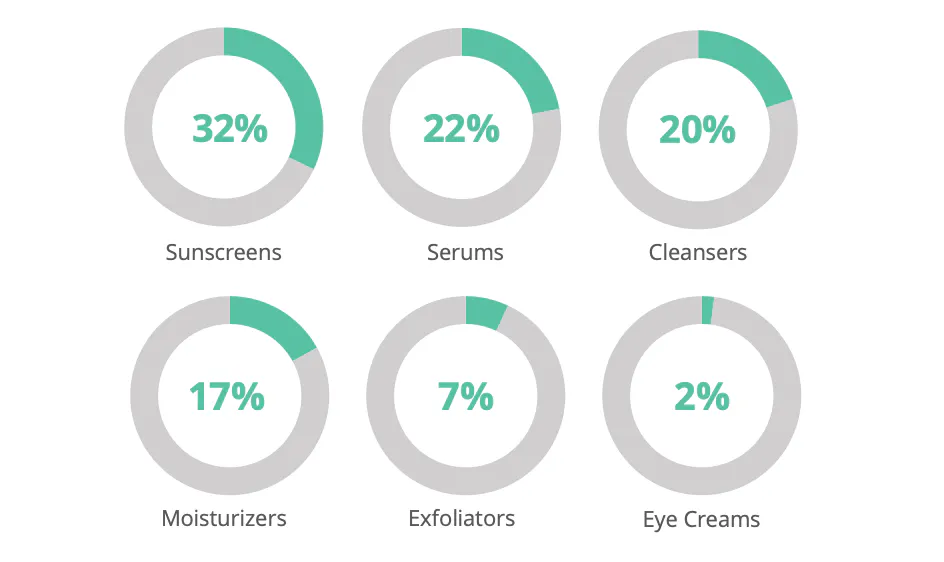

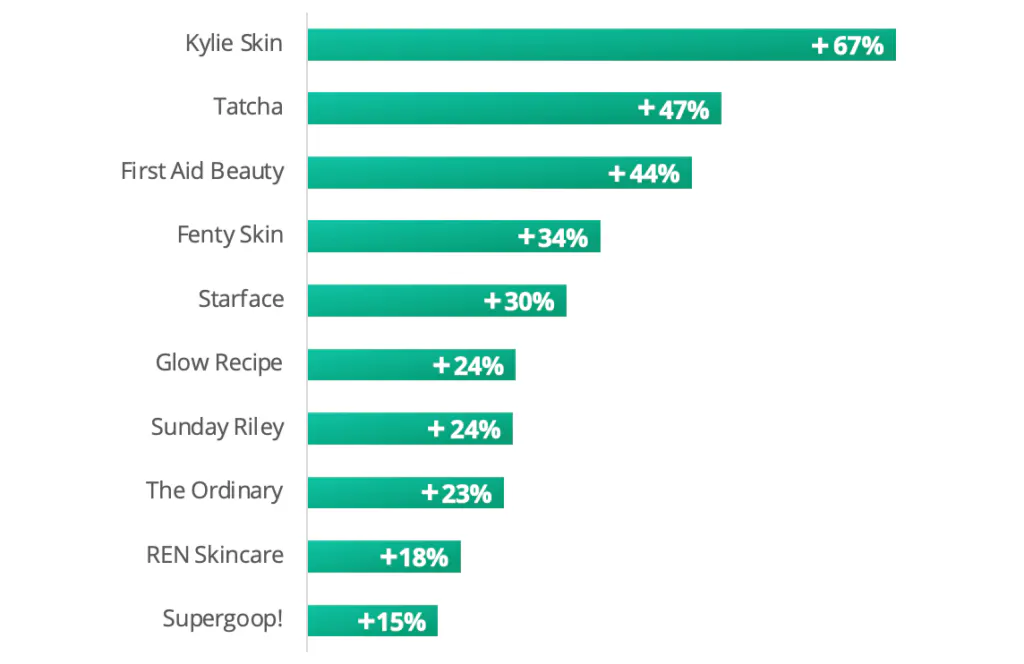

The first step to “glowy” skin is healthy skin, and this is reflected among ShareThis audiences. The top product searched and shared is sunscreen, followed by serums and cleansers. People want to keep their skin protected, healthy, and clear—and they’re listening more to those brands that have big influencers and science to back them up, such as Kylie Skin with Kylie Jenner and Tatcha with Kim Kardashian and Kate Middleton. Tatcha is a perfect example of when science and influence collide. Tatcha prides itself on crafting products inspired by natural Japanese ingredients and rituals that care for your physical, mental, and emotional health. Their scientific approach caught the attention of many influencers, including Kim Kardashian, and gained traction from organic online endorsements.

Top Searched and Shared Skincare Products by Percent Share of Engagement:

Fasted Growing Skincare Brands by Average Month-Over-Month Growth:

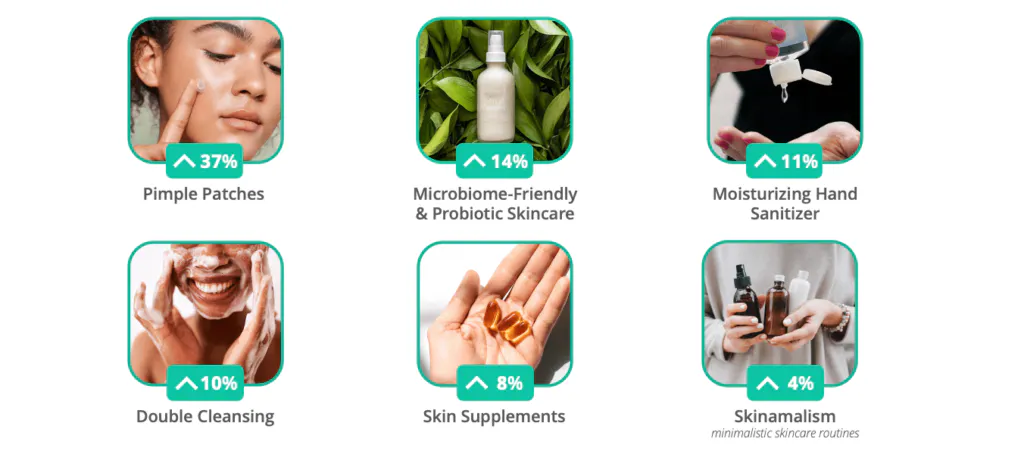

Following that focus on clear skin, the top trend in skincare among ShareThis audiences is pimple patches, showing a 37% growth in engagement WoW. Skinamalism—minimalistic skincare routines—are a newly growing trend brought on by the notion that too many competing products can cancel each other out, or even harm delicate skin. This has led to simple routines with powerhouse products that boast multi-tasking ingredients. The trend is slowing growing at an average of 4% week-over-week. However, Kylie Skin’s product line is the fastest growing skincare brand MoM, so it looks like influence may be beating out science in this category.

Average Week-Over-Week Engagement Growth of Skincare Trends (%):

Keeping Hair Simple and Light

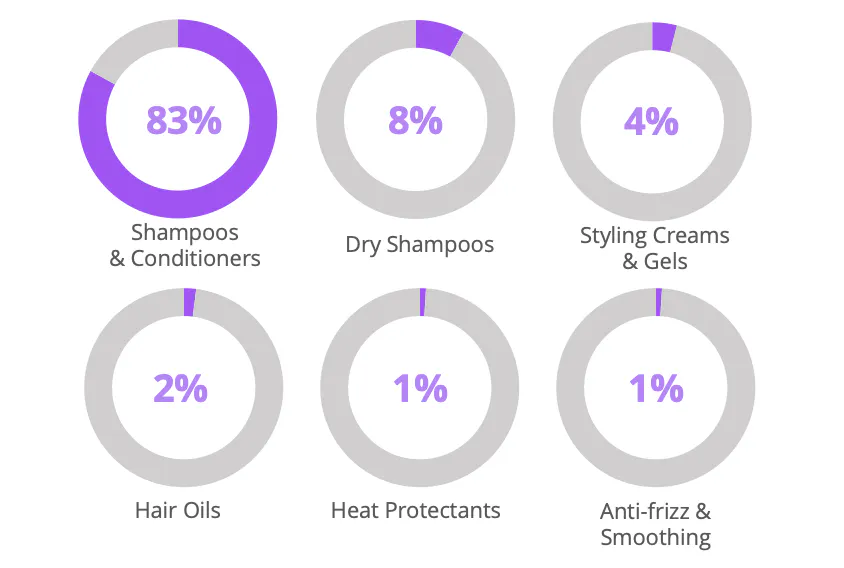

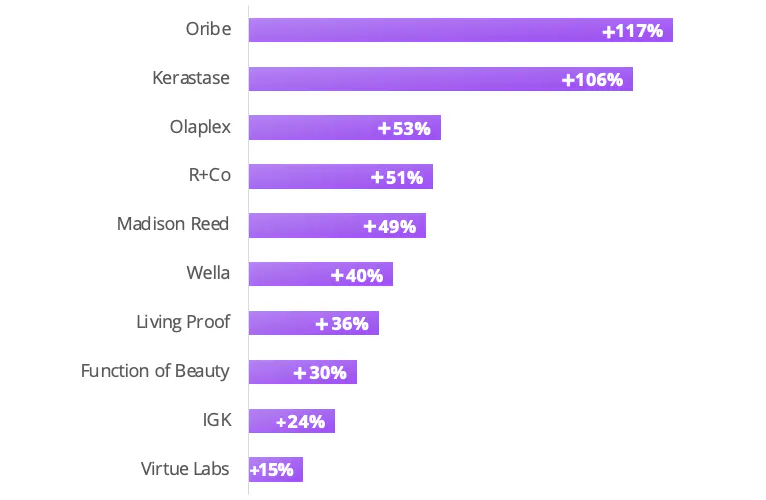

While skincare products continue to innovate, hair products seem to be focusing on the basics rather than diversifying. Shampoos and conditioners make up 83% of all product searches and shares among ShareThis haircare audiences. Compare that to any of the other hair care products all with less than 10% growth and most below 5%. Meanwhile, Oribe is the fastest growing brand in hair care among ShareThis audiences with Kerastase just a bit behind them, both growing more than 100% MoM.

Top Searched & Shared Haircare Products by Percent Share of Engagement:

Fastest Growing Haircare Brands by Average Month-Over-Month Growth:

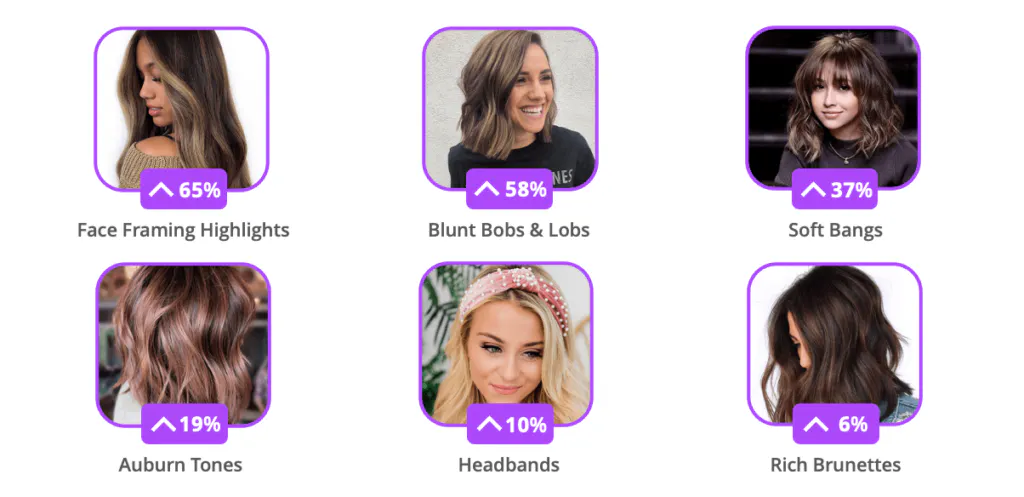

People are also liking that lighter look with face-framing highlights, and it’s reflected in their searches, which have grown by 65% WoW. Blunt bobs and lobs are right behind with a growth of 58%. A few other trends, like headbands and rich brunette tones, trail behind at 10% and 6% growth respectively.

Average Week-Over-Week Engagement Growth of Haircare Trends (%):

Where to Look for What’s New

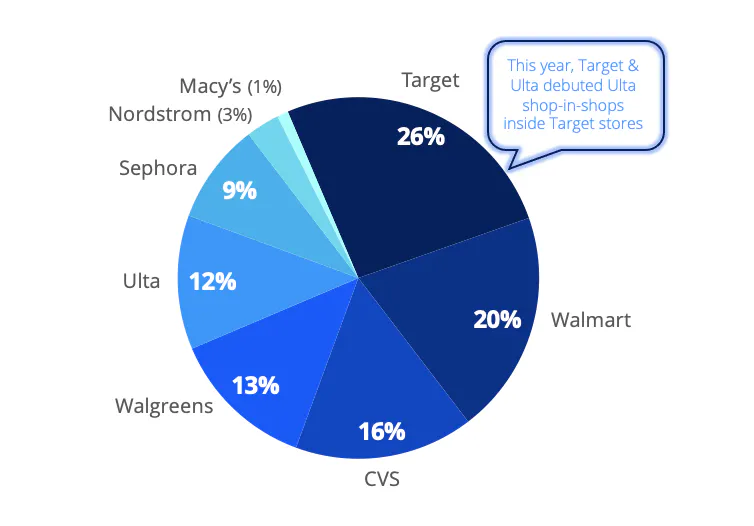

Across all categories, beauty lovers are interested in discovering what’s new. It makes sense that when they’re in discovery mode they’re shopping at more affordable stores—like Target, which held 26% of the market share for new beauty discoveries, and is trailed by Walmart at 20%. No one wants to invest hundreds of dollars in a product they’re not sure will work for them. This trend toward discovery may have influenced Ulta Beauty’s decision to open shop-in-shops within Target stores, and it is even an interesting side note that may contribute to Ulta outpacing Sephora. Sephora’s brand is built around being the experts and inviting consumers to come and learn, whereas Ulta has positioned themselves as the fun place to come discover and explore as consumers try out what they’ve seen on social media. This emphasis on affordable and fun discovery appears to be making a difference.

Retailer Market Share for New Beauty Discovery (%):

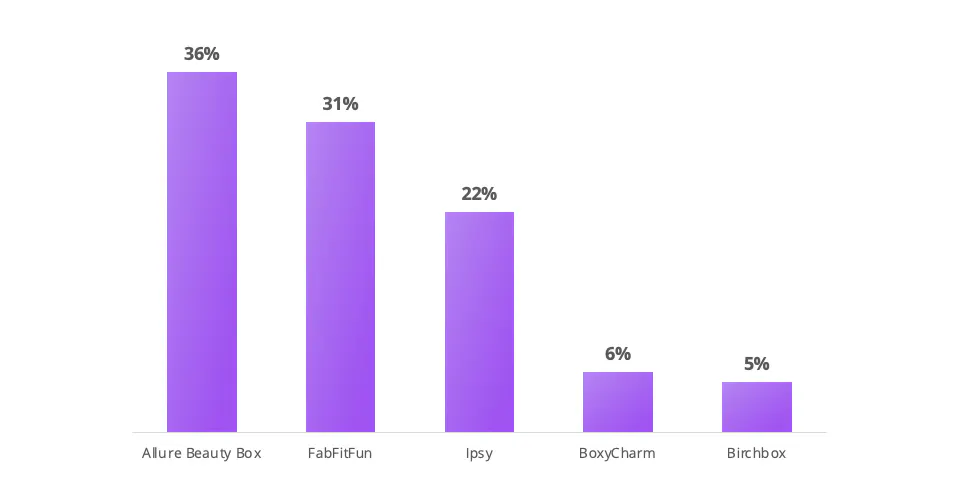

We’re also seeing this trend toward curated exploration reflected in beauty boxes. Allure Beauty Box, which is a more affordable option that offers new—but vetted!—beauty products to try, has higher engagement over its competitors. Some of the alternatives, such as Boxycharm and Birchbox, may offer cheaper subscriptions; however, they send products that are still seeking approval rather than ones that have already won loyal fans. And FabFitFun’s appearance here may suggest that consumers may be interested in exploring beyond makeup—their interests overlap with other aesthetic hobbies like interior design.

Top Beauty Subscription Boxes by Percent Share (%):

Finding the Beauty in the Data

There are a lot of different facets to the beauty industry and, more importantly, beauty audiences. It can be hard to keep it all straight, but with the right data you can determine how to appeal to customers and keep up as styles and preferences change. Don’t just play catch-up; take the lead.

Contact us if you’d like to use our data to keep up with your customers.