Consumer packaged goods have had a wild ride over the course of the pandemic. But what doesn’t kill (your product line) only makes you stronger. Behavioral product trends have emerged and waned, including hoarding, delivery and pickup, supply chain issues, and now hints of a return to the way we used to engage with our essential products.

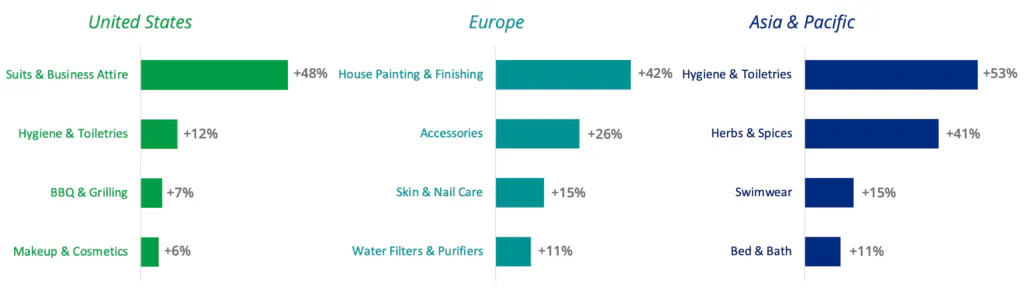

Globally, ShareThis is seeing personal care products picking up the most steam. Returns to daily routines, travel, and meeting others in person again have allowed for recent growth in hygiene products, skincare, and more, in addition to a desire to nurture ourselves as the stress of the pandemic continues. We can also see the effect of the pandemic in these trends as Asia was hit with the new Delta variant first, while the U.S. has been focused on going back to work and school, and Europe is behind the two other regions having only just entered normalcy with widely available vaccines.

Recent Average Month-Over-Month Category Growth by Region (%)

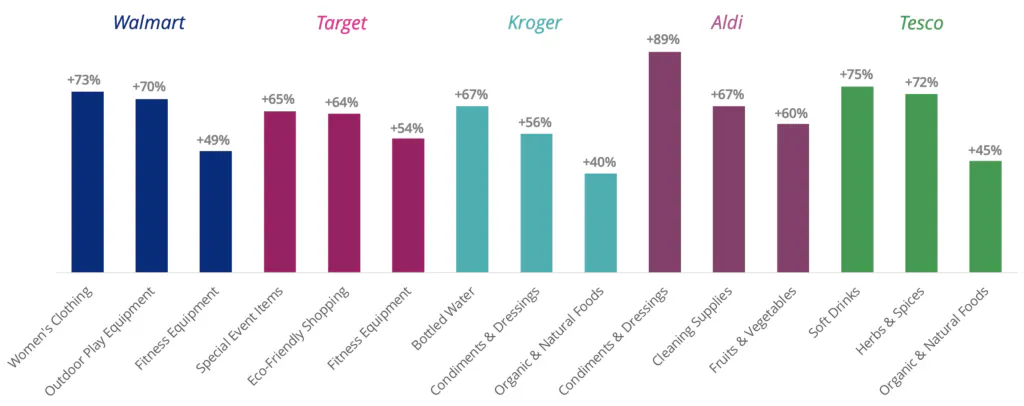

Major retailers are also seeing growth in non-essential categories, which is a good sign for the global economy. Clothing, special event items, and entertaining staples like condiments and spices are increasing this summer.

Average Month-Over-Month Category Growth by Retailer (%)

While products purchased may be more familiar, the consumer journey to get those products is showing signs of permanent change. Although bulk shopping behaviors aren’t as popular as last year (down 30% year-over-year), bulk shopping is still up 37% as compared to pre-pandemic. As consumers remain nervous about the potential for lockdowns and strains on supply chains, bulk shopping behaviors will stay.

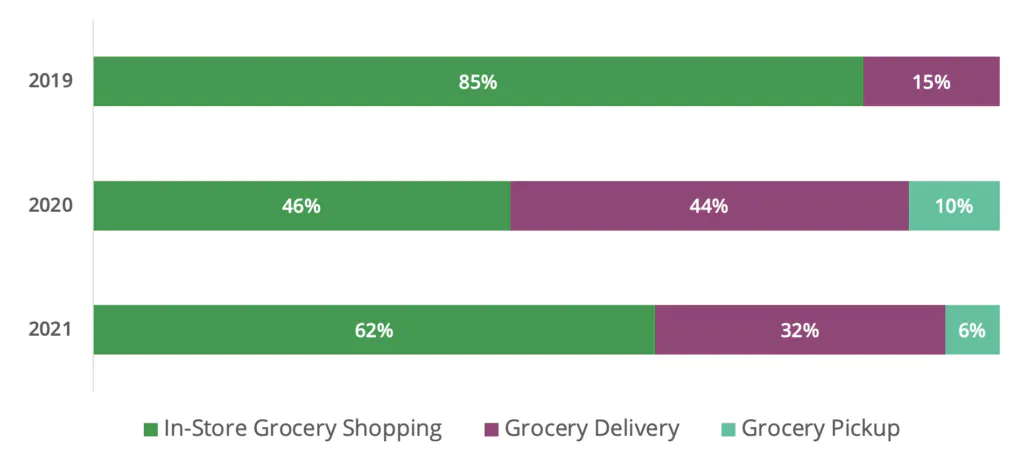

Grocery delivery and pickup will also stay with us for the time being – they’ve made consumer’s lives easier, and so they are emerging from the pandemic as a new time saving solution. The pandemic nearly tripled grocery delivery behaviors in 2020, and it’s still around, even as foot traffic returns to grocery store floors. We can see that pickup remains the least popular option since it still involves running the errand, albeit with less risk than entering the store – but consumers are already there, and have missed the experience of browsing while shopping.

Percent Share of Grocery Shopping Behavior (%)

Speaking of strategies that lighten consumer to-do lists, direct-to-consumer (DTC) brands are in their heyday. Just in the last few months, on average, online engagement has grown with DTC food and beverage by 33% month-over-month, DTC household by 31% month-over-month, and DTC fashion, beauty, and personal care by 26% month-over-month. Brands seeing particular 2021 success in these categories include Hello Fresh, Thrive Market, Brooklinen, Grove Collaborative, Olive & June, and Quip.

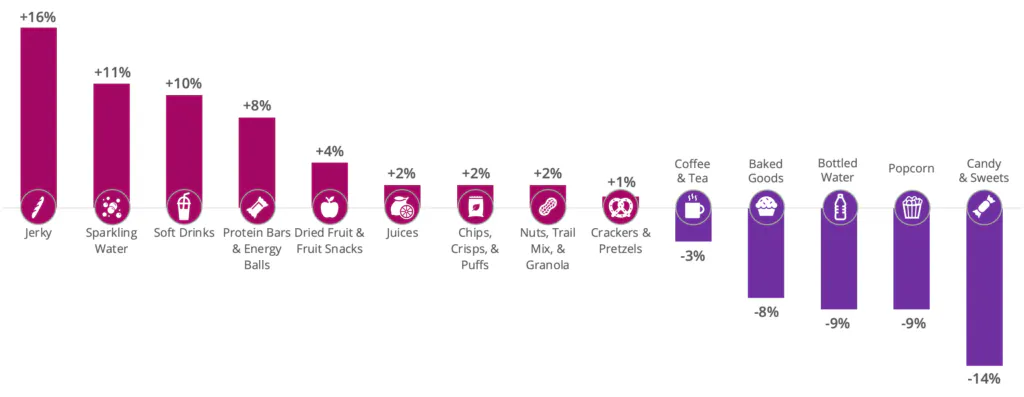

Innovation in snacking is also full of summer trends seeing recent month-over-month growth, including spicy flavors (+14%), natural energy drinks (+10%), high and added protein (+7%), kombucha (+7%), and mocktails (+6%). In fact, protein and carbonation in particular are grabbing consumer attention with innovations in classic snacking categories like jerky, sparkling water, soft drinks, and protein bars. The leading snacks all reflect the popularity of road trips and outdoor excursions this summer, as people find excuses to take grab-and-go items outside of their homes.

Traditional Snack Categories Gaining and Losing Momentum:

Average Month-Over-Month Growth (%)

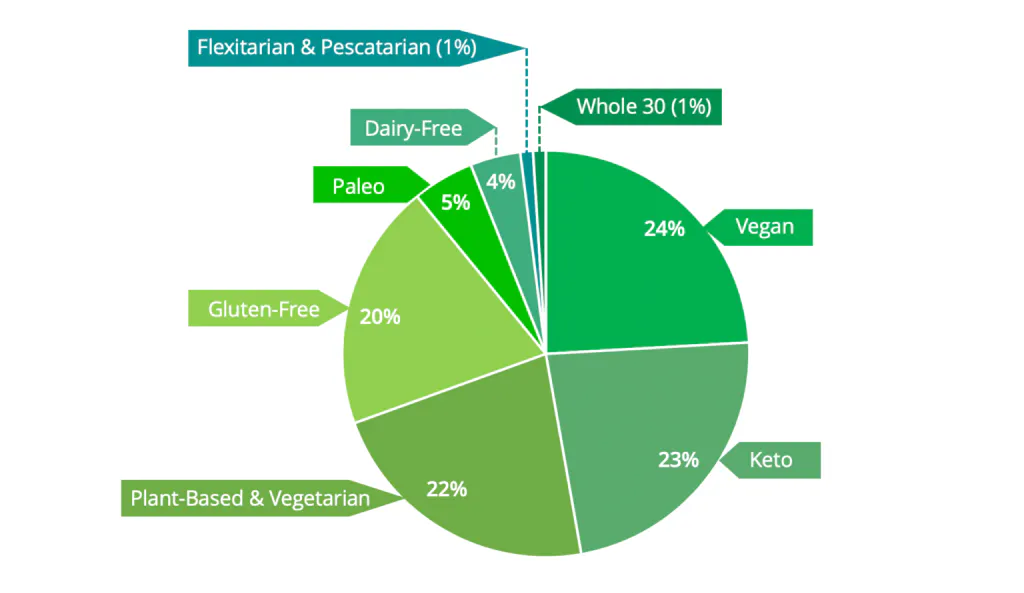

Some of these trends also reflect popular diets and health agendas that have entered mainstream snacking. When we look more closely at what a wellness-focused audience is looking for when it comes to their snacks, some diets and lifestyles are more popular than others:

Percent Share of Engagement by a Wellness Audience (%)

Plus, there’s more behind these diets and lifestyles than looking and feeling good. When we look at the keywords most searched by this audience, across all diet types, we can see that wellness consumers want food that will contribute to their overall health, even giving them natural boosts in electrolytes and essential vitamins and minerals. Unsurprisingly, they want clean and natural ingredients that don’t have added sugar and preservatives. But what did surprise us was how intertwined sustainability is with their health goals: wellness-focused consumers want products that nurture both the earth and their bodies.

Top Searched Keywords by a Wellness Audience

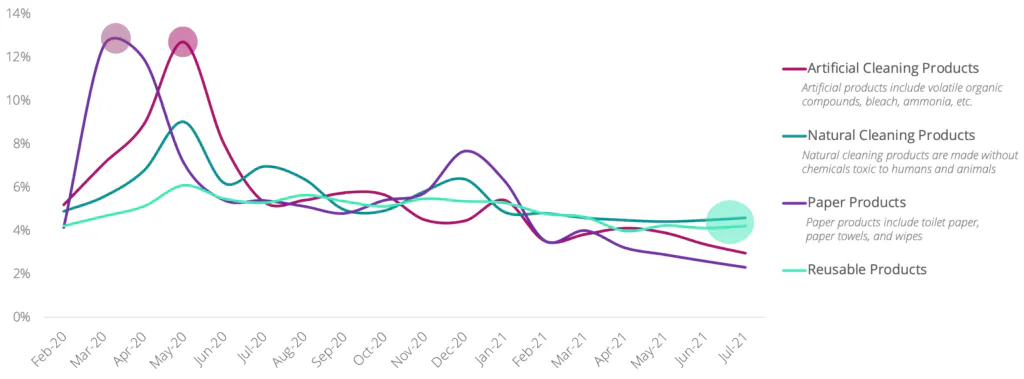

Natural and eco-friendly agendas go further than snacking, too. Before we knew how the coronavirus was spreading, consumers were limiting the amount of time that products spent in their home by purchasing single-use products and heavy-duty chemicals. Now, eco-friendly and natural options are outpacing those products:

Percent Share of Engagement With Household Products (%)

In the beauty industry too, natural looks and products are preferred right now over dramatic and synthetic options. Over the last year, searches have increased dramatically for paraben free (+57%), aluminum free (+48%), and antibacterial and probiotic skincare (+23%). The most searched summer beauty trends also lean toward enhancing natural beauty: soft cat eyes, french tips, no-makeup makeup, and more:

Most Searched Summer Trends by a Beauty Audience:

Volume of Searches Versus the Average Search Count

While we haven’t reached a new consumer behavioral equilibrium just yet, there are key trends we’ll continue to keep our eye on:

Contact us if you’d like to use our data to follow along with trends in consumer packaged goods as they continue to evolve.