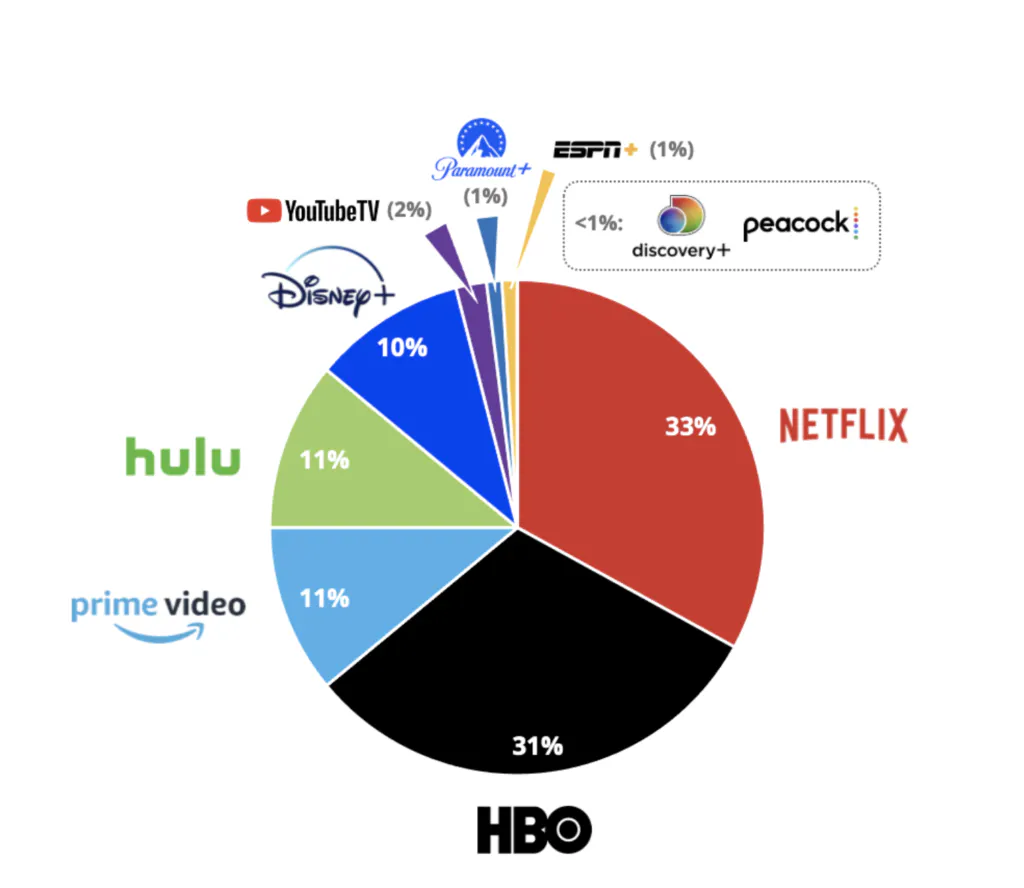

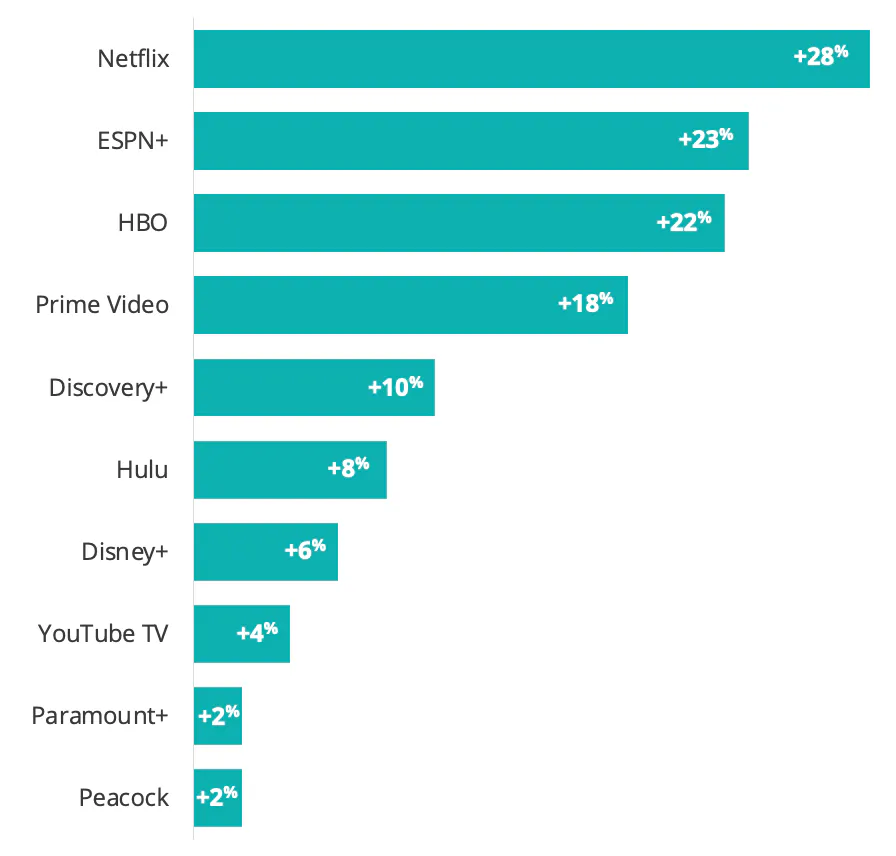

Everyone knows Netflix is king in the streaming space. Will any service ever catch up? In recent years, innovations by HBO, Amazon Prime Video, Hulu, and Disney+ have earned them favorable positions in the streaming race, and new services pop up regularly. However, Netflix and HBO together double the share of voice of their competitors in ShareThis data. Although smaller services are growing, Netflix and HBO are growing too, and are powerful enough to swallow the competition. The field is narrow, and if top competitors continue to innovate and buy out smaller services, they will keep their share of the market.

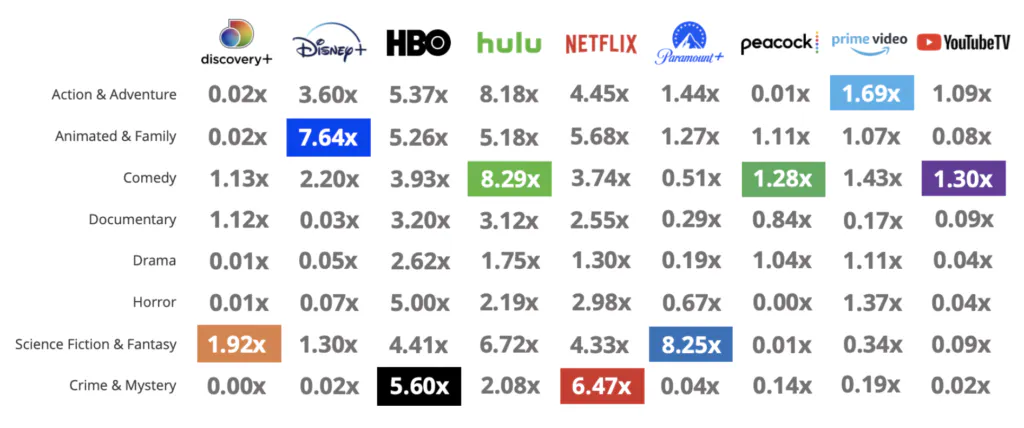

The best way that a service can hold its own in the space is by winning over a specific niche audience. If fans of a particular genre or content style consider it their go-to service, it will be harder for the entertainment monoliths to take them over or steal their subscriber base. So, we’ve reached the era of experimentation, with streaming and CTV services searching for that niche. ShareThis data reflects where each service is strongest with their current audience below.

Streaming Service Index by Genre:

Another way to hold onto a service’s corner of the market is by offering benefits that differ from their competitors. As the CTV audience grapples with subscription fatigue, too many ads or paying a premium for ad-free content, paywalls, and packages, we’re reaching a crossroads. Are we headed for a great rebundling, where the top services swallow those beneath them, or an all-out subscription war?

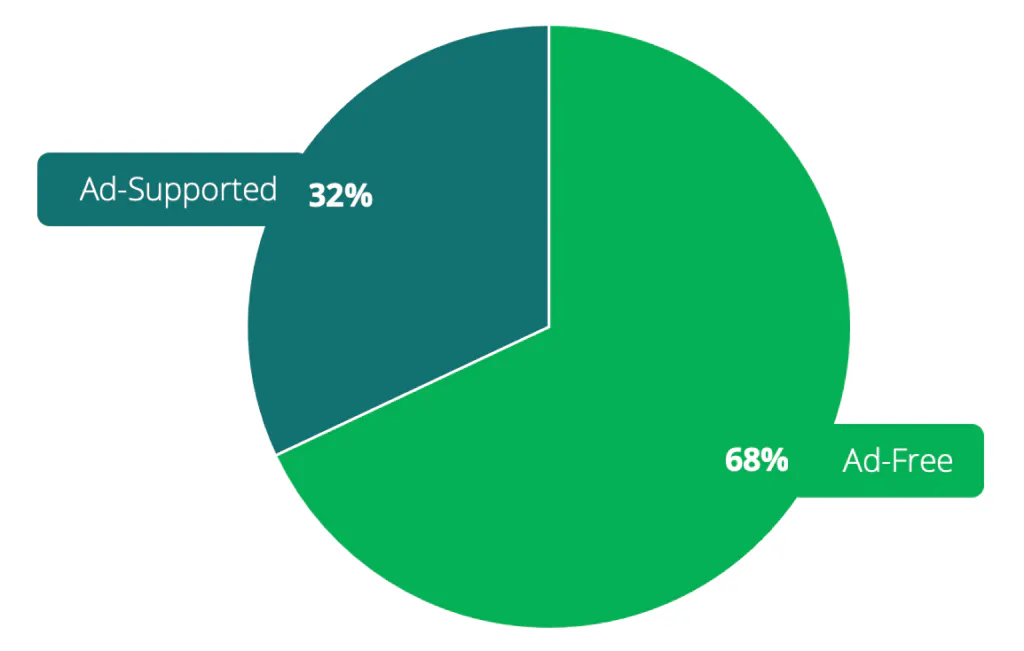

Over the last year, streaming services have experimented with their offerings. Engagement with live TV options has increased 213% year-over-year by a global streaming audience, while social signals around the many bundles, buyouts, and mergers in the industry have grown by 58%, and straight-to-streaming and paywall content releases have increased 32% year-over-year. Meanwhile, free trials have declined in engagement by 29% year-over-year as they’ve been pulled from plan offerings, in favor of new content acquisitions, original content, or bundles with other services to lure in new subscribers. Entertainment companies are also exploring tiered subscription plans to see what their audience values most. ShareThis examined the split between ad-free and ad-supported content by a global CTV audience:

Percent Share of Engagement Globally for Ad-Free Versus Ad-Supported Content (%):

It looks as though consumers are more willing to pay more for ad-free content, though there is certainly a cap to the amount they will pay. Incremental payment models allow subscribers to choose their own level of advertising, alongside other premium offerings.

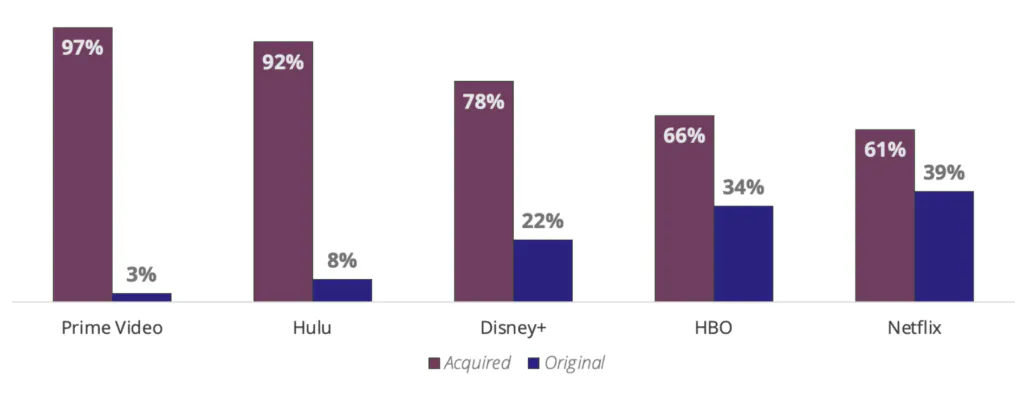

Original content is the newest race in the streaming landscape. Instead of the legal rigamarole of acquiring and expiring content rights, hits like Stranger Things from Netflix or Westworld from HBO have allowed these services to outright own content, and are catapulting prior streaming providers into production houses of their own. This move was a gamble, but searches for original content versus acquired content show that original content is a successful diversification strategy. The major streaming services are opting for more original content to draw in more viewers, and the trend has paid off – the more original content available on a service, the more viewers are seeking it out.

Percent Share of Searches for Acquired Versus Original Content (%):

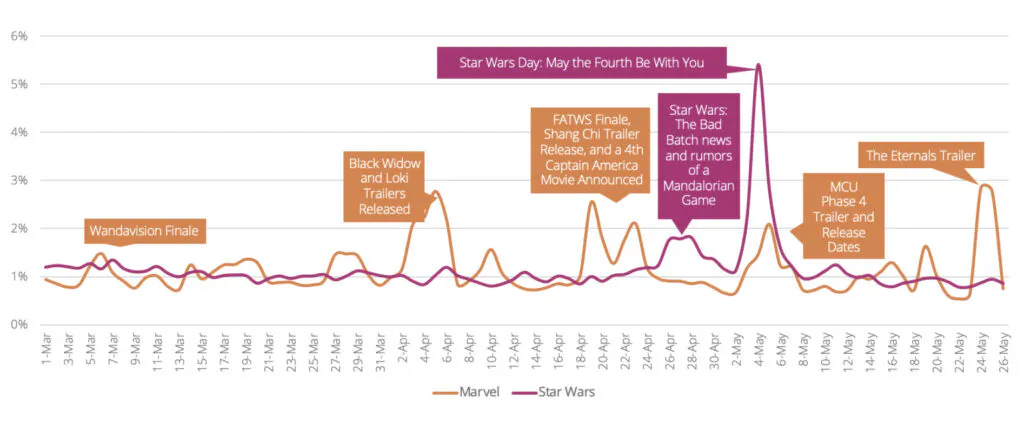

Another big cash cow at the moment are franchises, especially franchises that step outside of the norm and touch all of the entertainment mediums: movie releases, episodic tv show releases, and “always on” social media content for fans to interact with. No one is doing this more successfully than the Marvel and Star Wars franchises at the moment. Their content releases in every form guarantee them consistent high engagement from their fan bases. Fans always have something to look forward to – and something to spend their money on. Streaming services should be looking for franchise opportunities.

Percent Share of Engagement With Marvel and Star Wars Franchises (%):

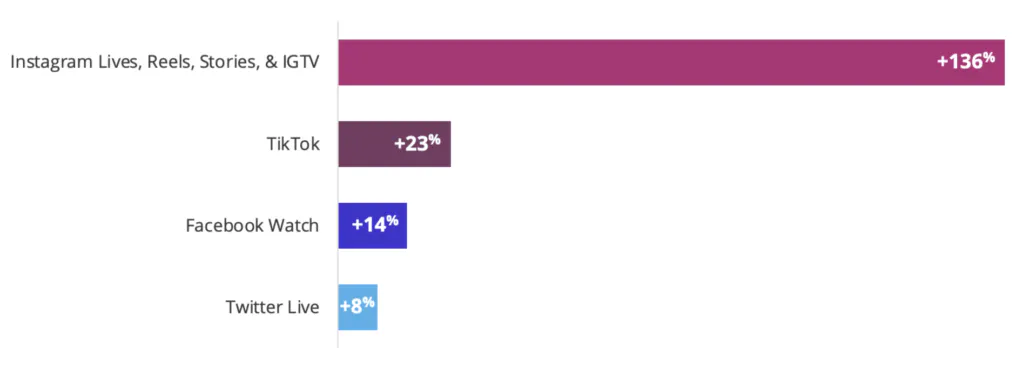

Speaking of the “always on,” all entertainment medium approach, streaming now has to compete with social media. Channels and platforms that used to rely only on text and imagery have caught up to streaming with innovations in video content, and younger generations are spending more time on social media than watching traditional movie and tv releases. The growth in Instagram lives, reels, stories, and IGTV, TikTok’s massive growth, and the ability to watch streaming videos on Twitter (even live events!) suggests that the lines are quickly blurring between content platforms.

Year-Over-Year Change in Online Engagement (%):

What’s next for streaming? Based on the data observed, ShareThis has predictions for the future of the CTV and streaming space:

Contact us if you’d like to use our data to follow along with the streaming category as it continues to evolve.