Financial Services is a dynamic sector, contributing 21.2 percent to the U.S. gross domestic product (GDP) as of Q3 2021. Yet, the industry faces growing disruption from well-funded fintech start-ups, and a consumer base driven less by loyalty than by the quality of relationship with their financial services providers. The pressure is on to capture and retain clients.

Values Added by Industry: Financial Services Contributes 8.5% to U.S. GDP

In fact, according to the McKinsey & Company Next in Personalization 2021 Report, while 71% of consumers expect companies to deliver personalized interactions, 76% get frustrated when it doesn’t happen. But there is good news. According to the same report, companies that excel at demonstrating customer intimacy generate faster rates of revenue growth than their peers. Plus, companies that grow faster drive 40% more of their revenue from personalization than their slower-growing counterparts.

Clearly, being able to discern and match consumer interests with brand experiences is a game changer both for acquiring and retaining customers. But to accomplish that, you need data that can illuminate context and reveal specific, actionable insights that help marketers identify personalization opportunities and convert online window shoppers into customers.

Behavioral and Interest Data Identifies and Scores Real-Time Consumer Context

Often marketers rely on point-in-time surveys and NPS scores. Or data from past interactions, feedback and purchases. It’s all helpful—but only to a certain point. Because it’s all in the past, it’s impossible to know what consumers are interested in right now. Perhaps they’re also looking for a new vehicle, or a change in insurance. Perhaps their family has grown and are exploring new home financing or education savings options. Or they’re ready to start a small business and enhance their retirement and savings strategies. In any of these situations, information about credit offerings, personal or business financial advising, as well as tax, brokerage or insurance options would likely be of interest.

Without a measurable understanding of consumers’ online activities and interests, it’s hard to design journeys that are personal and relevant.

Fortunately, real-time behavior and interest data is especially equipped to unlock measurable consumer insights based on browsing behavior, originating from page views, searches, clicks, and shares. These activities are indicators of consumers’ level of engagement and interests over time.Let’s look at how open web behavioral data can work for the Financial Services sector.

Two Finance Personalization Use Cases

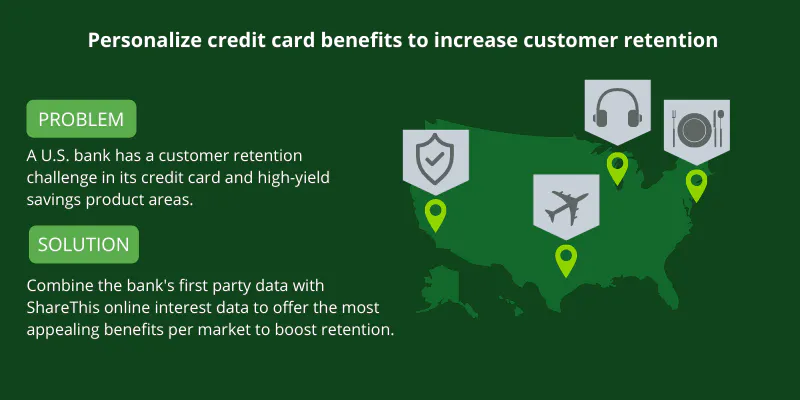

A U.S. bank has a customer retention challenge in its credit card and high-yield savings product areas.

The burst of easy credit options has taken a toll, cutting into revenue and creating dissatisfaction with credit partners. The bank wants to exploit the wide range of attractive benefits and activities their credit products offer, through a mix of introductory offers over email and text.

The bank is most concerned with four markets: New York, Austin, Chicago and Los Angeles. It can leverage curated online behavioral data to understand which zip codes in each of the regions over-index for interest categories related to their products and benefits, such as offers in Dining, Consumer Tech, Travel, and Insurance. This insight can come in the form of interest or intent scores. Behavioral data can also illuminate brand affinity, measuring a customer’s interest in the bank itself—for those same zip codes.

With these new data points, the bank can highlight or expand the most appealing benefits within those markets to boost retention, with special offers given to customers that are expressing current, real-time engagement with the bank.

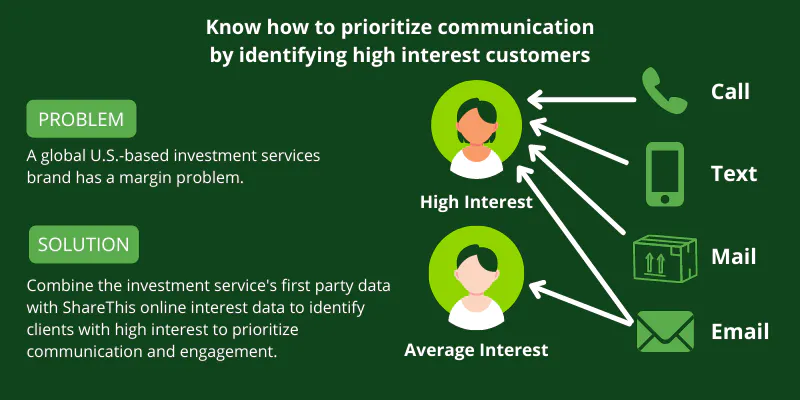

A global U.S.-based investment services brand has a margin problem.

Fees for its consultation services are at the high end in the industry, yet the results for these services are also among the best in the industry. This is especially true for individuals who use them early on, particularly when starting to pursue home ownership. The consultation service is an expensive and signature offering that the brand is unwilling to dilute by reducing price or simplifying the service.

The brand wants to ensure its existing clientele are aware of the advantages they can achieve by investing in this service and fully leveraging the brokerage services available to them. The marketing team has created a special offer for a free personal online or in-person trial of their consultation service, which also includes personal brokerage services.

The investment firm can use Category Interest Scores, based on real-time consumer behavior, to enrich their CRM and reveal which of their existing customers have recently or frequently engaged with topics around Home Ownership, Financial Planning, Investing and Retirement Readiness over the last 60 days.

The firm can leverage the assigned Interest Scores to prioritize engagement and communication with clientele depending on level of intent towards personal financial advising and direct investing. Those expressing average levels of intent could receive an email with the special offer, while those expressing the highest levels of intent could receive an email, SMS, direct mail, and a personal call from a consultant or concierge.

Increase Personalization—and Growth—with Real-Time Behavioral and Interest Data

Like many other sectors intent on recovering from the Covid Pandemic, Financial Sector firms are facing disruption from all sides: competitors, decreased consumer loyalty, changing buying patterns, and higher customer experience expectations—namely responsiveness, engagement on their terms, and personalization.

The irony is that brands have more data at their fingertips than ever before. But they don’t have the kind of data that identifies actionable context in consumer behaviors and interests. And that’s the necessary ingredient to growth-inducing campaign and journey personalization levels.In fact, research has shown that across sectors brands who invest in personalizing and curating consumer experiences are more likely to meet or exceed growth goals, with as much as 15 percent revenue lift attributed to personalization alone. Without question, behavior and interest data unlocks context and actionable insights, at scale, assisting with customer acquisition, retention and lifetime value.