Christmas might come early this year—or later, depending on when you choose to shop. Due to the shipping crisis and supply chain shortages influenced by disruptions during the pandemic, consumers may need to jump on holiday shopping sooner.

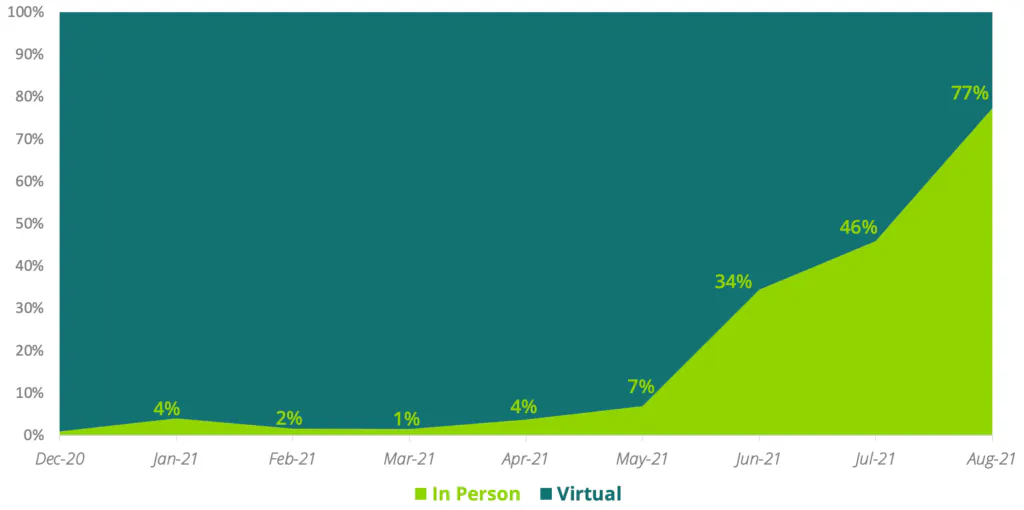

It may seem that people are eager to get back to “normal” — even ShareThis data is showing that 77% of August events were advertised as “in-person” and travel searches are growing 23% month-over-month. Even so, the pandemic is unpredictable, making some consumers a little gun-shy.

Luckily, we can unwrap the data to see where consumer behaviors are shifting, especially around how the pandemic might influence spending this upcoming holiday shopping season.

Supply Chain Shortage

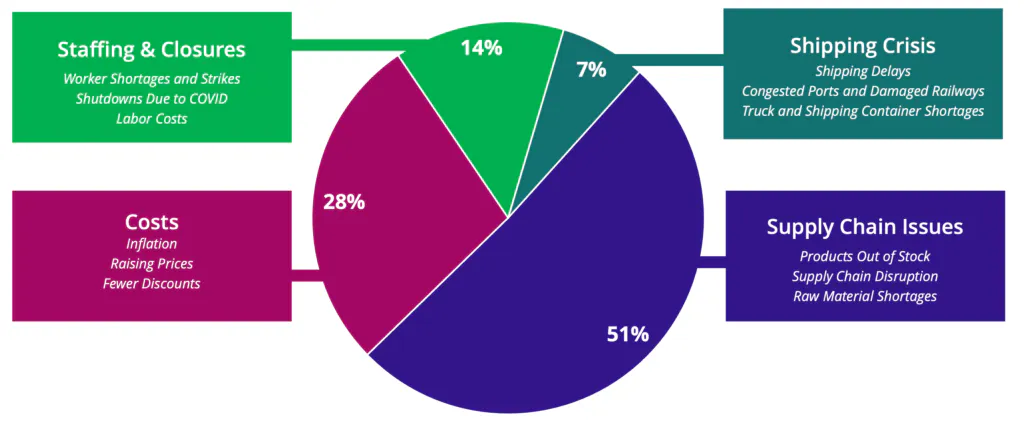

This year’s ShareThis data shows 51% of consumers are experiencing the biggest pain point with supply chain issues, making it a cause for major concern among retailers.

Threats to Holiday Shopping

Precent Share of Engagement by a ShareThis Global Audience (%):

What consumers are less aware of is a potentially more destructive pain point: the shipping crisis. Starting with the pandemic shutdowns worldwide in 2020 (and now again in 2021) and then compounded by factors like the Suez Canal blockage, the deep freeze in Texas, and labor shortages across the globe, we’re seeing a distinct ripple effect on supplies. Congested ports, damaged railways, and truck and shipping container shortages have tangled up shipping. Holiday shoppers who start late could cause supplies to become even more limited—in turn, forcing retailers to raise their prices. Worst case scenario, depending on how things go, people may not get their items until after the holidays.

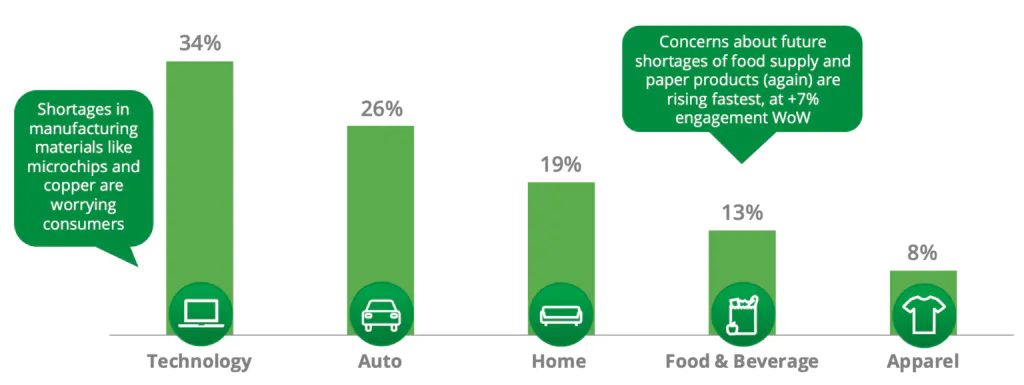

On top of all that, companies are having trouble sourcing raw materials. Our data shows that 34% of consumers are most worried about the shortages in microchips and copper impacting technology availability.

Key Industries Affected by the Supply Chain Crisis

Precent Share of Engagement by the Global Supply Chain Audience (%):

It’s unlikely that recovery will happen this fall. So if you are eyeing that new smart phone or gaming system, you might want to be the first in line to purchase. Many companies are putting their best foot forward by working to encourage early shopping—giving more time for goods to arrive and hoping to “flatten the curve” of holiday demand, without discouraging spending. To incentivize this early approach, retailers may be offering holiday sales as early as October.

Influencer Advertising

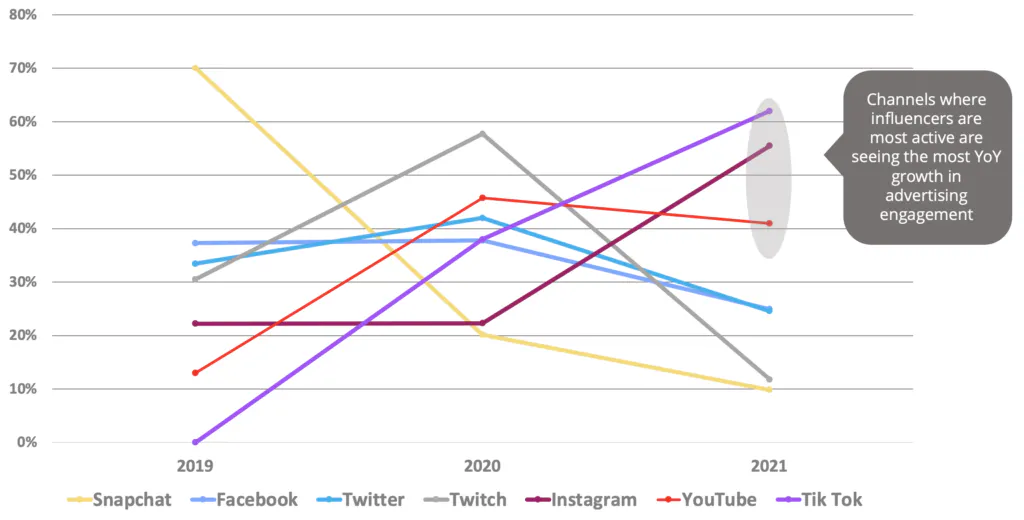

Speaking of sales, the data is showing that companies will find the most success in advertising on specific social media platforms.

Advertising and Social Media Channel Keyword Mentions

Percent Share of Engagement per Year by the Global Advertising Audience (%):

We found a whopping 8062% YOY online engagement increase in shoppable content on platforms such as TikTok, Instagram, and YouTube. These channels are where influencers are the most active and are seeing the greatest growth in advertisement—which may be driven by the fact that these platforms focus on short, quality videos that the user can easily create and edit.

Retail companies can get a leg up on the competition by focusing marketing efforts on these top platforms. In contrast, other social media platforms such as Facebook, Twitter, Twitch, and Snapchat have experienced a decline in advertisement engagement.

Visiting for the Holidays

Household items aren’t the only areas that have been impacted by the pandemic. Rain or shine, restrictions or not, we’re seeing people who are eager for interpersonal interactions. Now that people have had a taste of normalcy, it’s hard to go back to Zoom get-togethers.

Split of In Person vs Virtual Gatherings

Percent Share of Engagement by the Global ShareThis Audience:

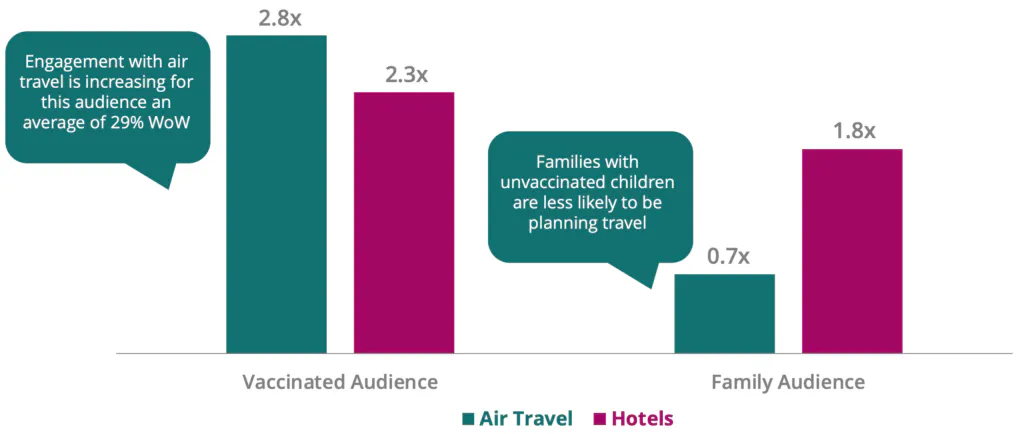

Vaccines are bolstering travel plans, too. We found searches and shares of content about traveling once vaccinated have increased month-over-month by 34%. Vaccines have also increased confidence around safe travel, as vaccinated people are 2.8x more likely to travel by air and 2.3x more likely to rent hotel rooms.

Online Engagement by the Vaccinated and Family Audiences

Audience Index for Air Travel and Hotels:

However, families with unvaccinated children are still hesitant to travel. They may be avoiding air travel and choosing the staycation option, but they’re still eager to get away and are looking at hotel stays. We think this could be an opportunity for package deals and all-inclusive options for local or nearby families.

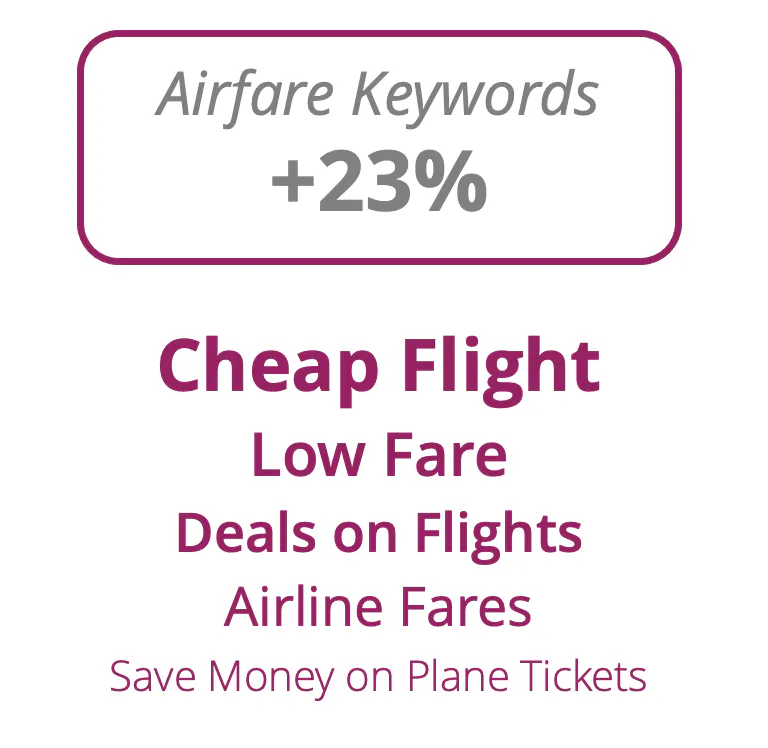

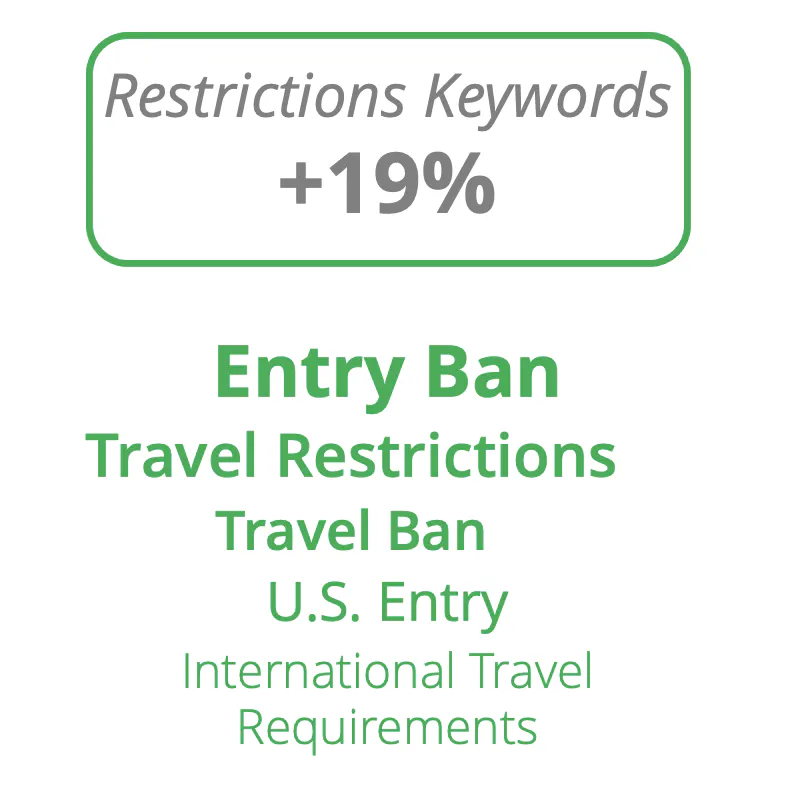

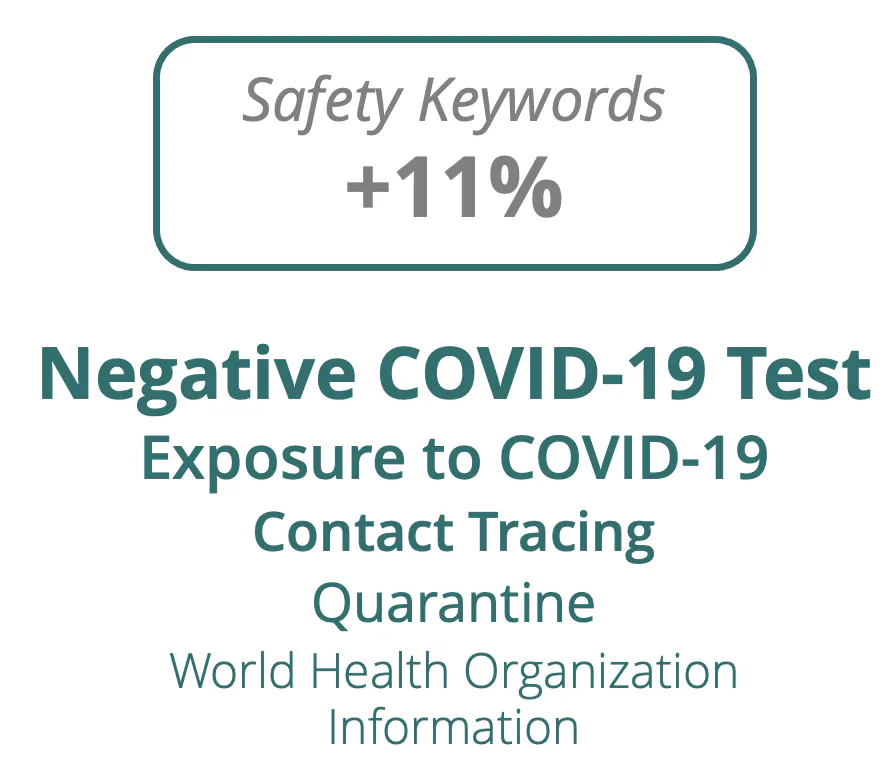

Restrictions aren’t holding people back either. Analysis of the ShareThis audience shows a 23% increase in airfare keyword searches such as “cheap flight,” “low fare,” and “deals on flights.” In contrast, safety keywords such as “quarantine” and “negative COVID-19 test” are only up 11%. This may indicate the beginning of a shift in attitudes toward a more pre-pandemic normal that prioritizes deals over safety. As long as airlines keep flying, people will keep buying.

Top Keywords

Recent Average Month-Over-Month Growth by the Global ShareThis Audience (%):

Save or Spend?

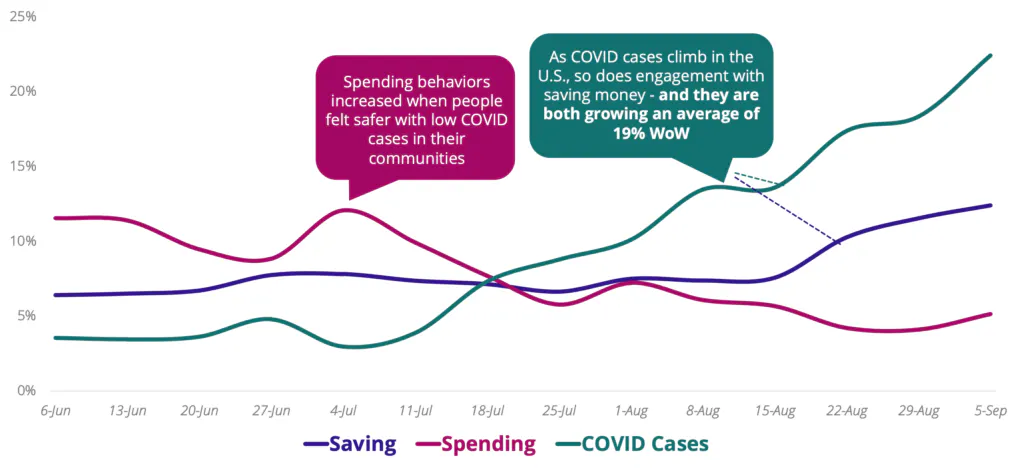

While it may appear consumers are trending towards pre-pandemic spending behaviors as they book flights and hotels for seasonal holidays, many are still hesitant to spend when the pandemic is still a prominent factor in their daily lives. We’ve seen that as COVID cases climb in the U.S., so does engagement with saving money. ShareThis data shows that engagement with saving money and concern with rising COVID cases are both increasing an average of 19% week-over-week.

COVID Cases vs Saving vs Spending

Percent Share of Engagement by a U.S. ShareThis Audience:

Spending behaviors increased when people felt safer with low COVID cases in their communities. This can make consumers less predictable, but may incentivize companies to continue to hold sales throughout the season for the cautious consumer.

Catering to the Consumer in a Pandemic

With shipping and supply chain crises, increased COVID cases, and yet more interest in travel, it is hard to tell what consumers will do this holiday season. But data is here to help. For a happy holiday season this year, we recommend using data to your advantage to identify what your ideal customer is doing and how you can best meet their needs in an ever-changing world.

Contact us if you’d like to use our data for your upcoming holiday campaigns.