A Year in Share

2017 surprised us all. It was the year of unprecedented sports wins, corporate scandals, and political strife. Our 2017 Year in Review provides a deeper look into the online content consumption behaviors of our social media audiences across the world – picking out notable insights and trends that make this year a memorable one.

The Big Numbers

In 2017, ShareThis captured 159 billion total social signals, including 1.1 billion shares and 17 billion click-backs on shared content globally.159BSocial Events1.1B+Shares17BClick-Backs

159B

Social Events

1.1B+

Shares

17B

Click-Backs

Devices

From where do users share content? Mobile continues to grow – within ShareThis’ network in 2017, 70% of sharing activities were captured from smartphones and 11% from tablets. That is a 3% growth compared to 2016, and 2 billion more sharing activities on mobile. Users are spending more and more time on mobile, sharing and clicking back on content shared by their friends, families, and people in their social network.

Channels

ShareThis social tools offer readers a plethora of channels for readers to share content. We looked at the year-over-year growth of share volume, by channel, to provide a peek at the top trending platforms of the year.

- Facebook is a declining medium for most social users – compared to 2016, Facebook lost its share of voice by 14% while Twitter gained 20%.

- The fastest growing social channel, globally, is WhatsApp. In 2017, shares to WhatsApp increased by 2x compared to the previous year, securing its position as a top social channel along with Facebook, Twitter, Pinterest, and email.

Politics

2016 was a polarizing year for politics, but 2017 political sentiment appears to have lightened. Since the presidential election, Trump’s neutral sentiment has increased by an average of 70%, while Clinton’s has increased by a whopping 290%! Perhaps, people are growing numb to politics in 2017, but we’ll let you make that call.

Brands

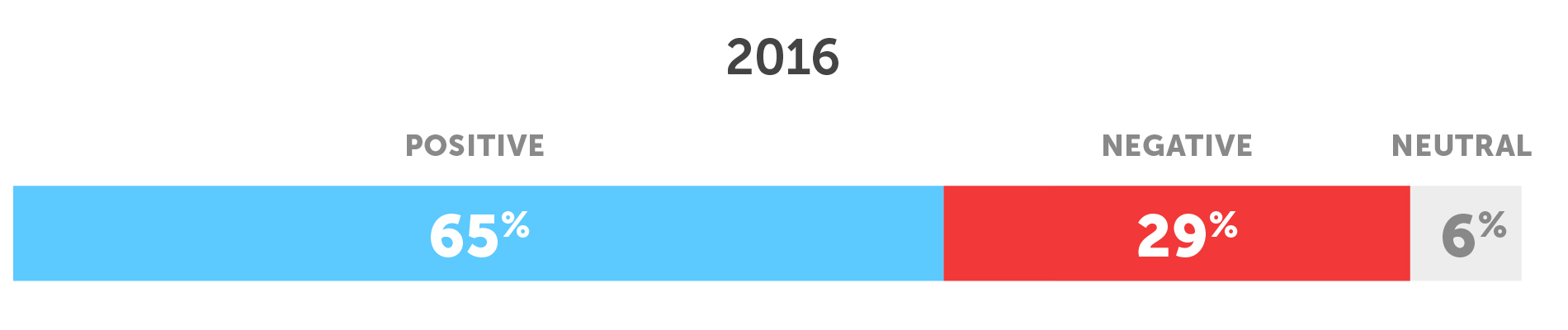

2017 was not a quiet year, and we have the sentiment data to prove it. Uber, United, and Pepsi were the three corporations most plagued by scandal and PR fails this year. Let’s see how social users reacted to top corporate controversies of the year.

2017 is considered to be Uber’s worst year ever, sparked by the two #deleteUber campaigns in January, followed by a leadership shake-up and an ongoing shareholder battle – and social data proves that to be true. Throughout the whole year, 60% of shared content around Uber talked about the company in a negative context.

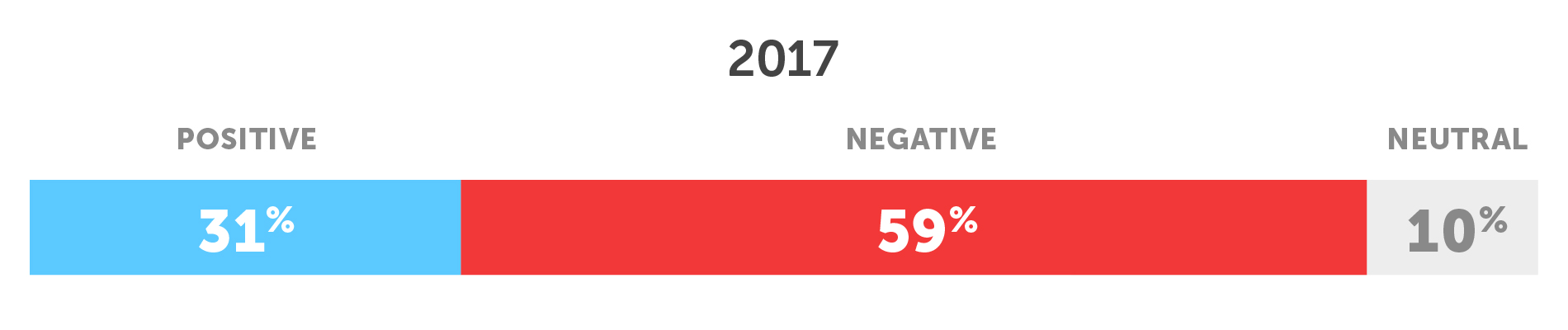

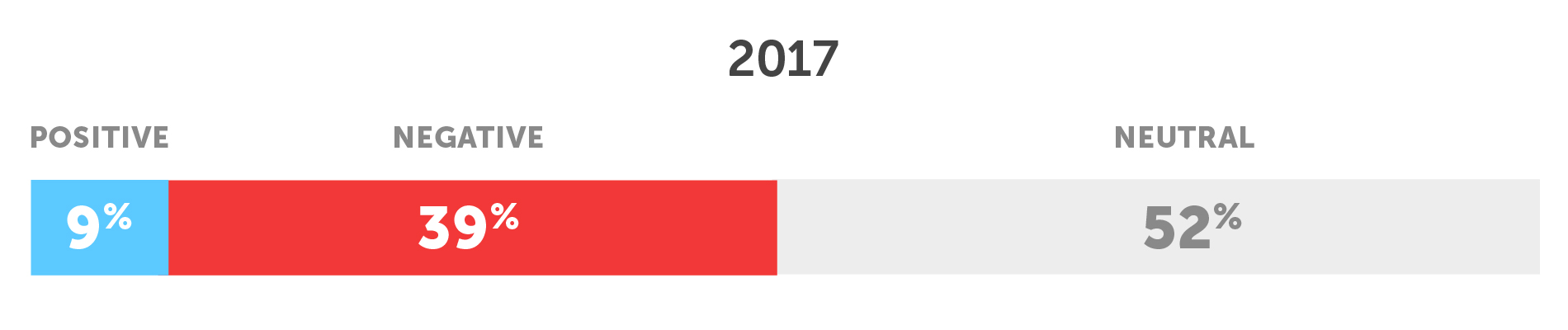

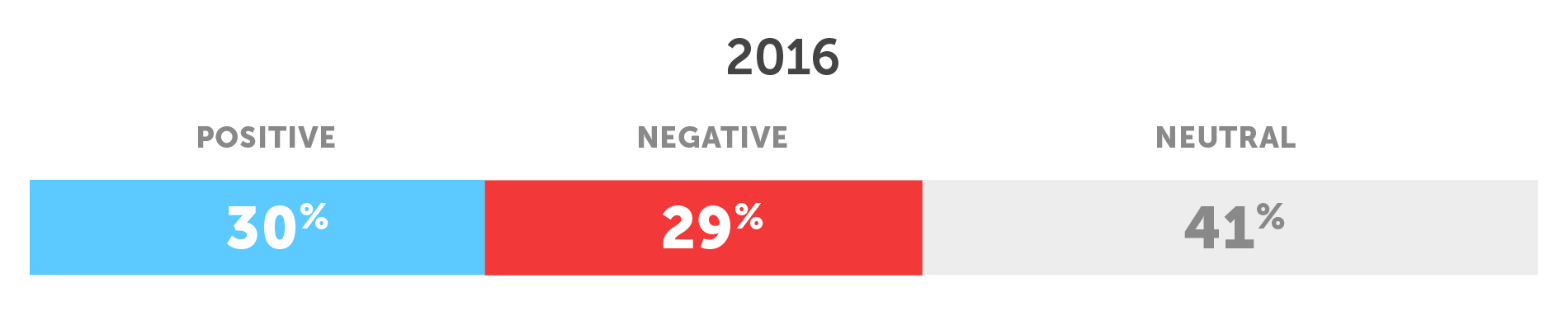

United Airlines’ stock plummeted after videos of a passenger being violently dragged off an overbooked plane circulated on the internet (April 2017). Following the incident, negative sentiment around United rose to 69% in May, contributing to an overall rise in negative sentiment to 39% in 2017.

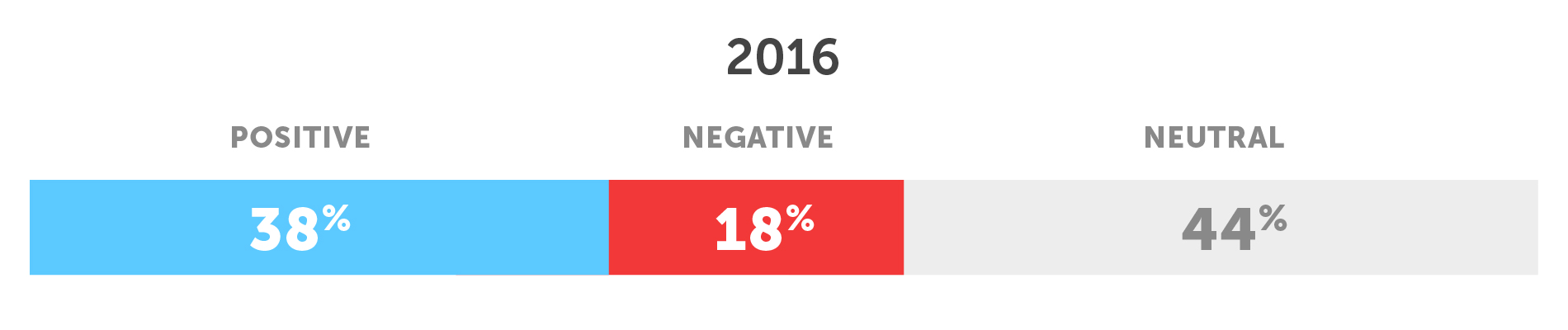

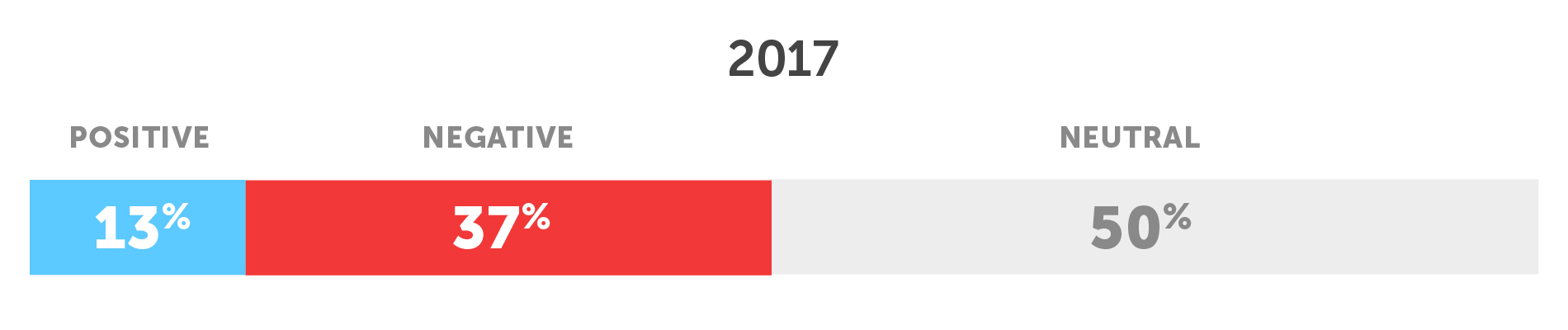

In April 2017, Pepsi released an advertisement featuring Kendall Jenner as a model who leaves a photo shoot and joins a protest, which was harshly criticized for co-opting imagery from Black Lives Matter protests. As a result, social sentiment around Pepsi fell to 36% negative share volume with only 18% positive share volume.

Movies

Superheroes are all the rage – the DC Comic movies (Justice League and Wonder Woman) top the list as the two most shared about movies this year. No surprises here!

Sports

2017 was another major year for sports. Tom Brady secured his fifth Super Bowl win in an epic comeback against the Atlanta Falcons to defend his title as one of the greatest NFL quarterbacks of all time. Although the Cleveland Cavaliers failed to bring home a consecutive championship win, King James maintains his spot as the most shared-about NBA star this year.

Football

Tom Brady

42M Events

Aaron Rodgers

15M Events

Ezekiel Elliot

14M Events

Basketball

Lebron James

24M Events

Kevin Durant

13M Events

Russell Westbrook

9M Events

2017 marked a year of several meaningful developments: the continued growth of mobile, the steady decline of Facebook as a popular social medium, and a gradual move away from a divisive political environment. Unexpected corporate scandals occur year-after-year, leaving us on the edge of our seats as we watch these brands rise or decline in the years to come.

Continue to leverage our data and actionable insights to fully understand the current changes in the broader social landscape. We are excited to see what 2018 has in store for us!

Interested in adding share tools to your site to understand your most shared about content and most used social channels?