Like so many things in our day-to-day lives, the COVID-19 pandemic has changed the way people relate to their cars. From weeks of staying at home to supply chain shortages to world events that drive up gas prices, we find our expectations and values shifting when it comes to how we get from here to there. Data from our ShareThis audience reflects how our relationship with our cars has evolved.

Car Buyers Stick With Their Favorites

Luxury Brand Shares of Engagement by a US Audience (%):

Mass Market Brand Share of Engagement by a US Audience (%):

Typically, when someone wants to buy a new car, they first look for their preferred automobile manufacturer. We’re seeing that this continues to be the case, with interest in certain popular brands rising above the rest.

In the luxury brand space, BMW and Lexus each claim about a third of our audience’s engagement, with Mercedes-Benz taking a smaller portion and Audi lagging at 7%. Commercial car brands are more divided: Honda and Chevrolet claim approximately a quarter of engagement signals from our audiences, with Toyota slightly behind at 16%, followed by several other car brands with smaller interest levels.

These are important trends whether you’re a car manufacturer considering a new loyalty or referral program or a dealer encouraging families with teens who are moving into the driver’s seat to stay within the car brand of choice for that family

Gas Price Fluctuations Spark Concerns

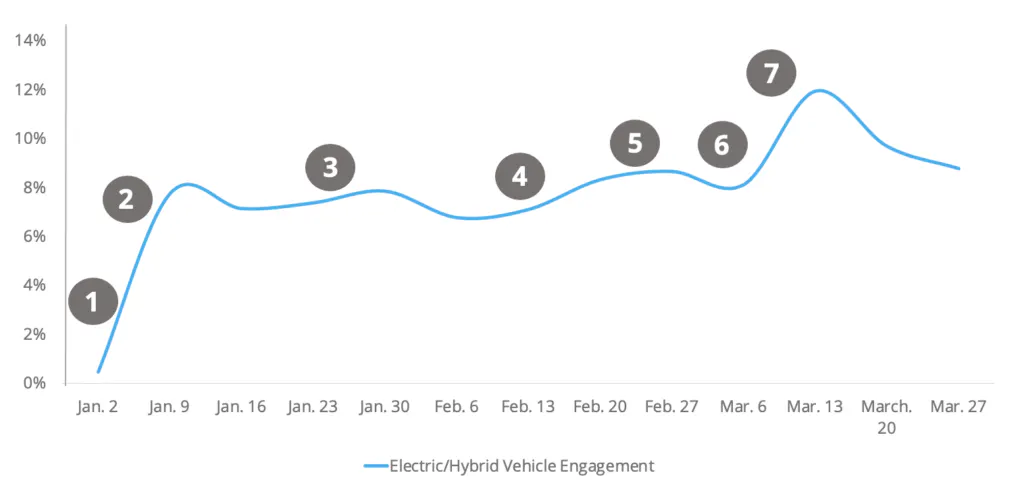

Engagement with Electric/Hybrid Vehicles by a US Audience (%):

- Articles forecasting a steep rise in gas prices begin to appear

- Think pieces predict that gas will rise to $4 per gallon

- Gas prices continue to climb for the 5th straight week

- Think pieces predict that gas will rise to up to $7 per gallon

- Russia invades Ukraine, raising concerns over oil availability and pricing

- Gas prices begin to skyrocket – the average US cost is now over $4 per gallon

- Gas prices are at an all-time high

Russia’s invasion of Ukraine and subsequent sanctions have caused a spike in gas prices. Our data shows that internet users are responding to the higher prices at the pump by exploring more eco-friendly options that won’t require as much gasoline.

In early January, interest around hybrid and electric vehicles trended upward following news reports that an increase in prices was likely, and this interest has trended with other news about increased prices. Gas prices hit an all-time high the week of March 13, and so did our audience’s engagement with signals about alternatives to traditional gas-powered vehicles.

New or Used? Interest Fluctuates

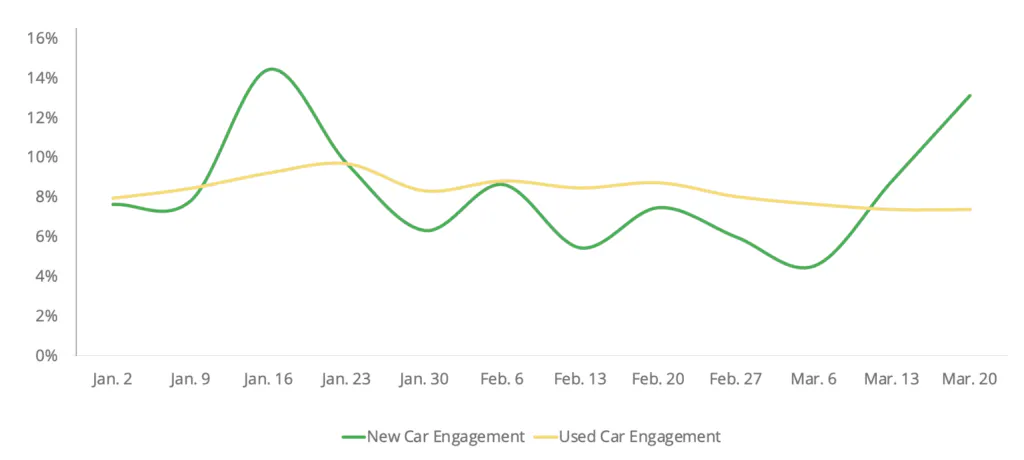

Engagement with New Car Keywords and Used Car Keywords by a US Audience (%):

The data shows our users are more interested in eco-friendly options––but they are less decisive about whether they want to shop new or used. Interest in used vehicles has stayed consistent over the last few months, most likely because users hope to get a good deal on a vehicle during a time of economic turbulence. However, our data shows that interest in new cars is much more sensitive to factors like shipping delays, supply chain shortages, and news reports.

Scarcity Fears Drive New Car Buying

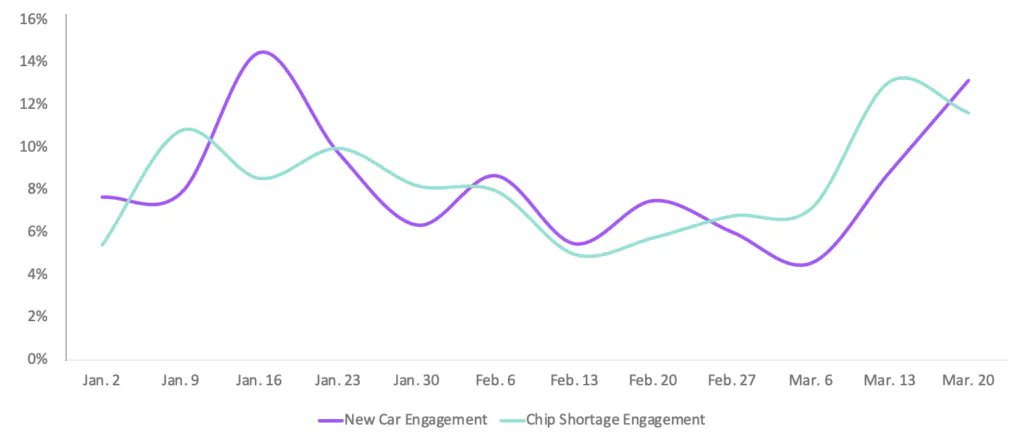

New Car Engagement Versus Chip Shortage Engagement by a US Audience (%):

In particular, shortages of the microchips used to manufacture new cars seem to drive fluctuations in our audience’s engagement with the topic of purchasing new cars. Our data shows that a rise in signals around microchip shortages is always quickly followed by a rise in signals about purchasing new cars. It seems that hints about shortages lead our audience to try and get their hands on new vehicles more quickly out of concern that there will be a shortage.

Conclusion

For many, cars are an essential part of their lives. Our audiences are concerned about trends affecting their ability to have the transportation they need and which options will be the most affordable and available.

If you are interested in using our data to better understand how your clients respond to trends online, contact us today.