Marketers have been scoring leads and customers for decades to progress consumers through their purchase funnels. Whether that involves ranking leads for sales teams, defining segments, or personalizing online shopping, scoring requires criteria, identifiers, and data.

Fortunately, with the digital boom, data of all types has never been more abundant—or more varied. Plus, computer processing power has grown sufficiently to put all this data to use and make artificial intelligence (AI) a household word—and experience.

The real change is that today’s consumers expect marketers to know what they care about. Achieving advertising efficiency that rocks ROI is like finding the perfect recipe. The secret ingredient isn’t sugar or other fillers, it’s advertising efficiency. And that results by combining behavioral and interest consumer data with consented data, along with third-party data like budget, authority, needs, and timeline (BANT) data.

Behavioral Scoring—Is It Really Worth It? The Answer Is Yes.

As early as 2012, Marketo benchmarked revenue and sales performance of firms that scored leads based on fit as well as Interest. The results were impressive. Revenue growth for firms using no scoring or just fit scoring was not just comparable, but the same. Sales time spent selling was slightly improved with fit scoring. Those firms that scored leads using fit and interest scoring grew revenue 12% and selling time 17%. Since then, the picture is only more compelling, as data access has grown and technology gains allow marketers to put that information to work in increasingly sophisticated ways.

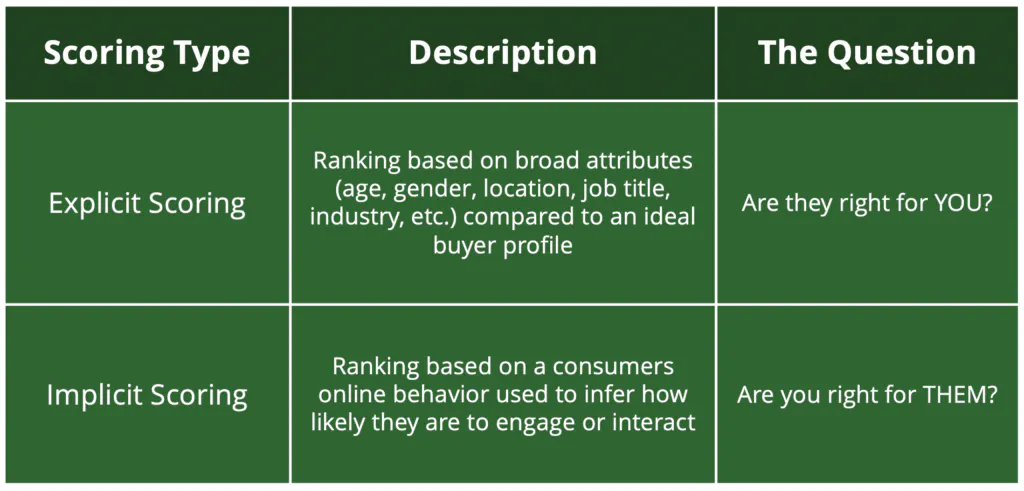

There are quite a few ways to score leads, but most of them fall into two types of scoring: explicit or implicit.

For example, fit scores (used to evaluate how much an incoming prospect resembles a likely buyer) are an explicit type of scoring. They rank broad attributes, like age, gender, location, job title, industry, etc., and compare them to the brand’s ideal buyer profile. The question most explicit scoring methods ask is ‘are they right for us?’

Interest scores get personal, and implicit, because they include details that can be inferred based on an individual’s online behavior. They rank how the prospect engages with your campaigns and content. Are they sharing it? Do they respond and retweet, download papers, or click through your Facebook or banner ads? Are they interacting on their phone or another device? What time of day? The question being asked here is, ‘are you right for them?’

Strengthen Your Scoring by Adding Intent to Gain Timing Insights

Adding budget, accountability, need, and timing (BANT) criteria can further refine your scoring. That’s important because as much as a target may value your product or brand, it may not be what they’re focused on right now. Or they may have other needs that are more pressing. Behaviors that might be highly correlated with prospects moving into a buying cycle, for example, could include clicking a banner ad for a how-to demo, sharing a detailed price page, or downloading an installation guide.

For each business or campaign, marketers will want to identify the specific behaviors that indicate the desired intent level. Combining that intent score with fit and interest scores can yield useful information that triggers a corresponding activation. For example, a high fit and interest score with a low buying intent score could indicate that more offering or education options are called for. The opposite configuration would indicate that the target is ready to act. Those triggers could be a direct sales call, a 10% off time-limited or a bulk discount option.

Three Use Cases

Targeting & Activation

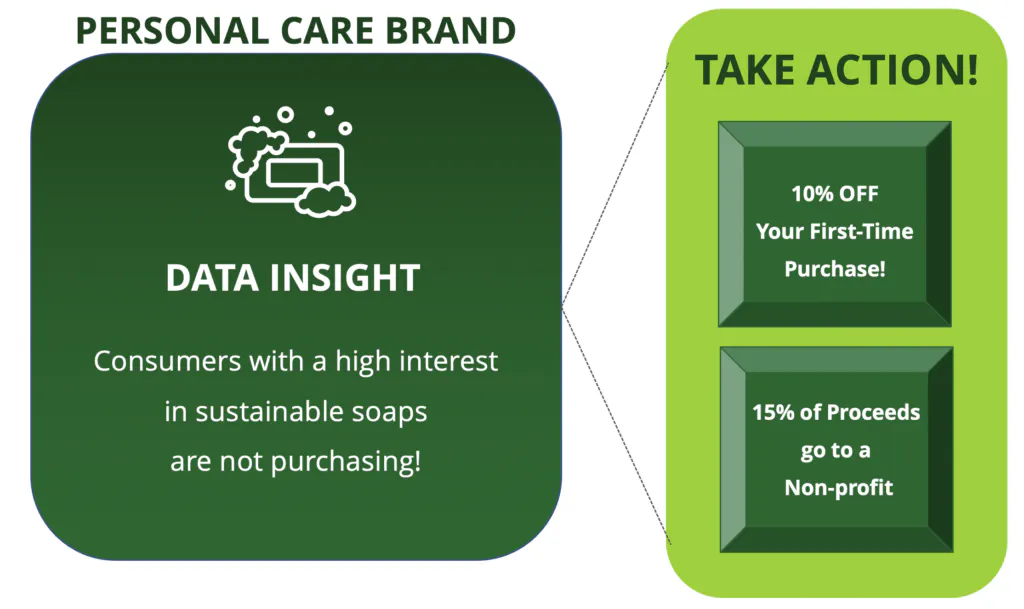

A personal care company uses an event feed with raw or curated data schema elements, delivered daily, to get additional behavioral data about consumers revisiting their website to then trigger personalized experiences.

What did they do with the insights? The brand discovers a large sub-group of consumers who have a high interest in sustainable soaps but haven’t yet made a purchase. The brand targets this sub-group with a two-part, personalized experience:

- An exclusive 10%-discount on their first purchase

- Content about how a percentage of the proceeds the brand receives for sustainable products goes to non-profits focusing on waste reduction.

Product Development

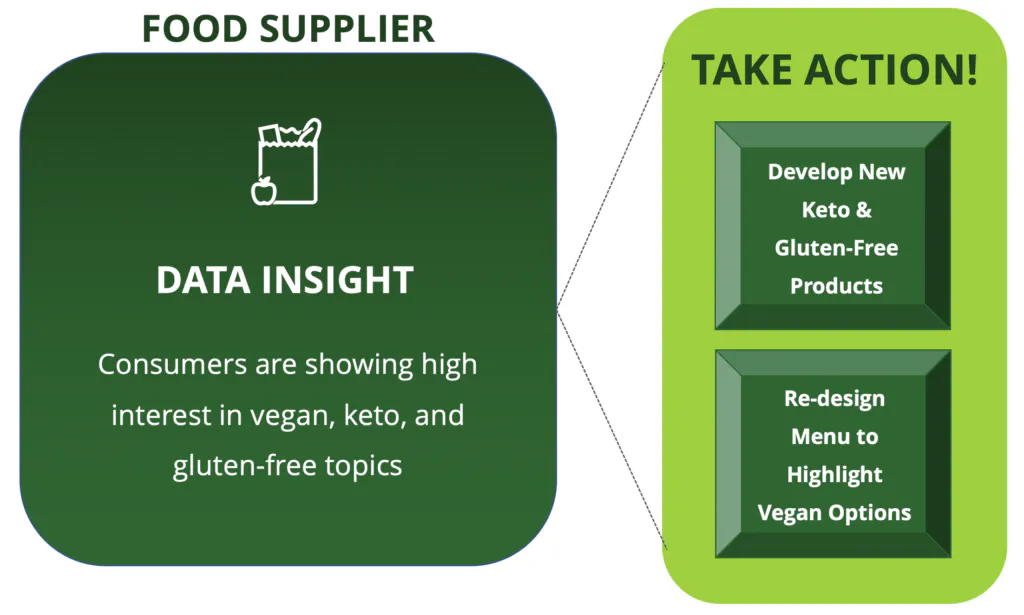

A food company uses an event feed with raw or curated data schema elements, delivered daily, and a CPG interest scores to target consumers showing interest in vegan, keto, and gluten-free products in the U.S.

What did they do with the insights? In this case, the data justified increased investment in new vegan, keto, and gluten-free products to meet growing demand.

Customer Acquisition

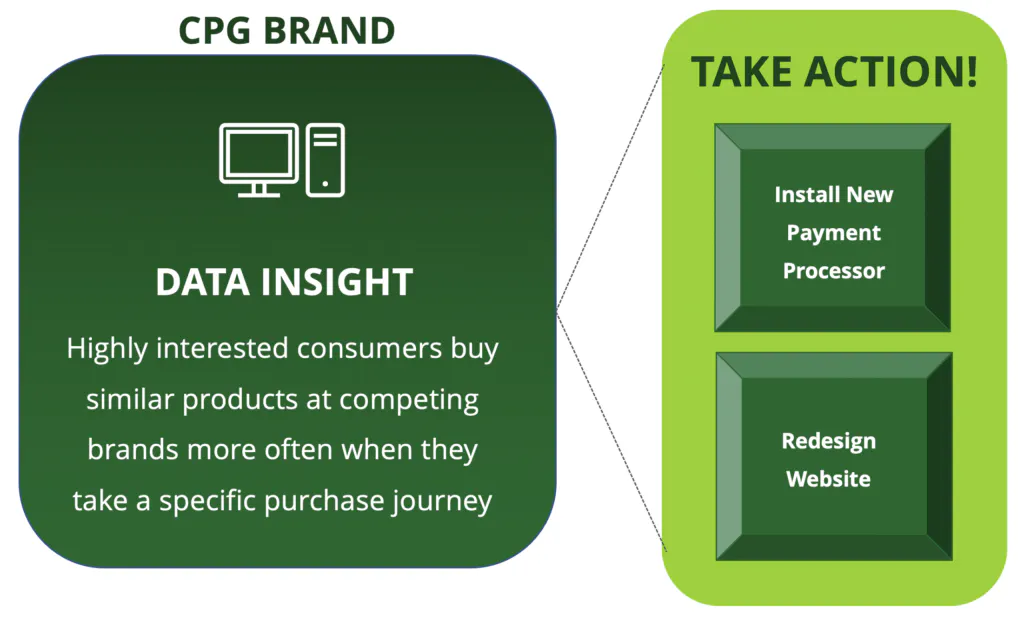

A brand uses curated data with synched feeds to understand how consumers shop for a category of products across different retailers to then optimize the purchase journey.

What did they do with the insights? The data made it simple to identify less effective:

- ad imagery, which could be quickly enhanced, tested and optimized

- online user experiences such as site organization and online support programs

Operational Insights

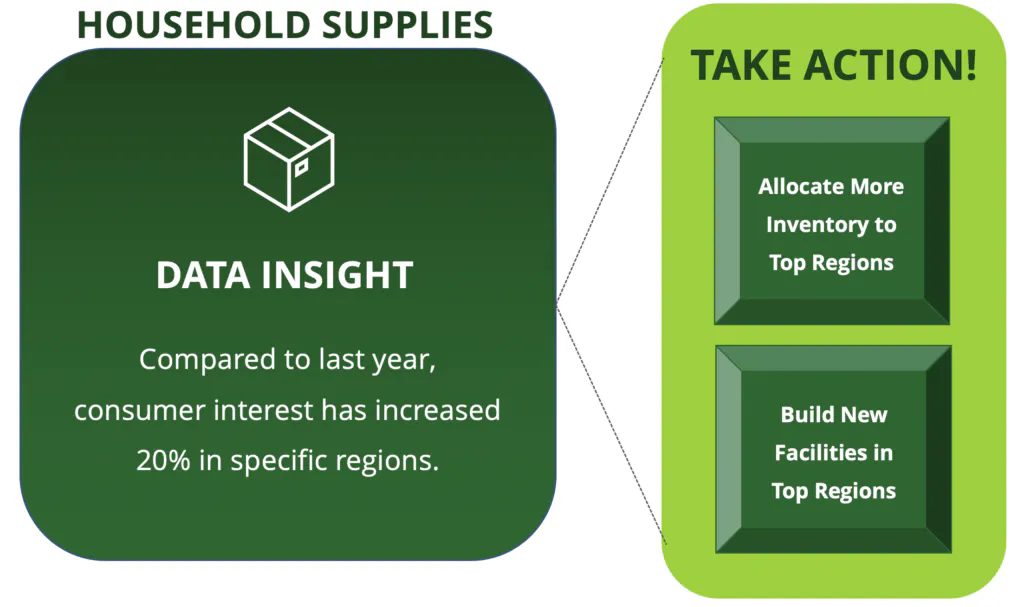

A household supplies brand uses historical and ongoing data to advance their predictive analytics and improve their supply chain processes.

What did they do with the insights? Consumer patterns became visible, for example:

- Previously undetected purchasing patterns—including weather, season, product line and location—allowed the brand to allocate inventory more effectively and meet consumer preferences.

Today’s marketers have more options than ever to understand what data can reveal, thanks to its terrific proliferation and technological advances. Combining broad demographic data with category and intent and behavioral consumer data can yield much more than ‘scoring’. It can tell a story, complete with heroes, journeys and happily-ever-afters: personalized campaign experiences, effective journeys, and happy encounters. A sure recipe for ROI.

Takeaways

Combining explicit and implicit data yields more reliable scoring. Curation and analysis matter. Combining behavioral, fit and interest data has been shown to deliver increased revenue and time spent selling.