With an estimated 1.145 trillion MB of data created per day—given increasingly digital shopping behaviors from today’s consumers—it should be easy to pull the most important pieces of information you want and act upon them. But it isn’t, at least not if you want to understand its context.

Data solutions that can securely meld the retail data that brands own with real-time consumer behavior data are few and far between. But for the consumer-packaged goods (CPG) industry, that’s where the treasure is: indexable and actionable insights into consumer trends and interests.

Online behavioral data that comes from the open web and features interest scores can help CPG industry experts distinguish the activities of anonymized consumers. It can also be tailored to meet highly specific specifications to suit client needs.

The Value—and Limitations—of Checkout Scanner and Panel Data

It’s understandable why the CPG industry overall relies on scanner and panel checkout data to identify target households for their brands, categories, and products. It’s proprietary. It’s accessible. And it’s controllable in terms of privacy compliance. But it’s also limited in value. The signals obtained from these devices include how a consumer paid for merchandise, which brands they purchased, how many products they purchased, and which products they returned or exchanged. These metrics can be compared over time to identify popular products, products that haven’t been purchased within the last month or year, and brands that consumers appear to have abandoned.

All of these data signals are from previous store visits or purchase data, limiting the currency, context, and scope of what can be gleaned from it. Analyses using this data are limited to using past interactions to place users and their households in groups of potential future customers for advertisement purposes. What’s missing is visibility into customers’ current behaviors and considerations.

The Antidote, However, Is Just as Limited

Retailers, unlike CPG brands, tend to ‘own’ the consumer data and purchase histories. They hold valuable proprietary signals—such as the amount of time consumers spend on which pages, how they get there, where they go afterwards, what they prefer or never buy, etc.—and they have become aware of the gap inherent to checkout data. As a result, retailers are now monetizing these signals and offering it to CPG brands and service providers to augment strategy decisions. Even given the privacy-compliant access these signals can provide, there remain significant limitations. In short, retailer- or brand-specific signals, in general, are limited to their owned digital and brick-and-mortar properties, and still based largely on past purchases and actions.

What’s Missing? Online Consumer Activity Across the Open Web

Consider this: according to Statista, as of January 2021, there are 4.66 billion active internet users worldwide – 59.5% of the world’s population. Of this total, 92.6% (4.32 billion) accessed the internet via mobile devices.

How do consumers spend their time online? Besides social media, where Facebook wins with 44.6 billion hours spent there per year, it’s Google, where consumers spend 213.1 billion hours a year searching, reading and watching. YouTube, which is owned by Google, garners another 142.6 billion hours a year from internet users. FYI, there are only 9,050 hours in a single person-year. That’s a lot of data to leave unexplored for decision-making.

ShareThis Brings It All Together

ShareThis fills the gap with real-time interest data–data that isn’t limited to one side of the firewall or transaction. Put the power of the internet to work for you with eighteen billion monthly events–including clicks, shares and searches–generated by 1.5 billion web users across 3 million global websites.

Identify consumer sentiment to gain competitive advantage

By augmenting proprietary data with curated online behavioral data, brands, online retailers and brick-and-mortar stores can identify groups of consumers that satisfy campaign criteria, just as checkout data does. For example, a Grocer could gain competitive edge in key markets by identifying consumer sentiment towards specific Baking Goods Brands over the last 30 days, and adjusting ordering, special offers and coupons accordingly.

Consumer Sentiment towards different Baking Goods Brands in the last 30 days

Sentiment scores are scaled between -1 (completely negative) and 1 (completely positive).

Identify cross-interests to optimize personalization and performance

Brands and retailers can use ShareThis data solutions to boost engagement among consumers and exceed campaign goals, all thanks to greater specificity of product category, location, and time of engagement.

For example, a Food Specialities retailer could optimize personalized shopping experiences for specific locations with cross-sell or upsell opportunities, by identifying other product categories consumers are interested in over the last 30 days, resulting in better campaign performance and a deeper consumer-brand relationship.

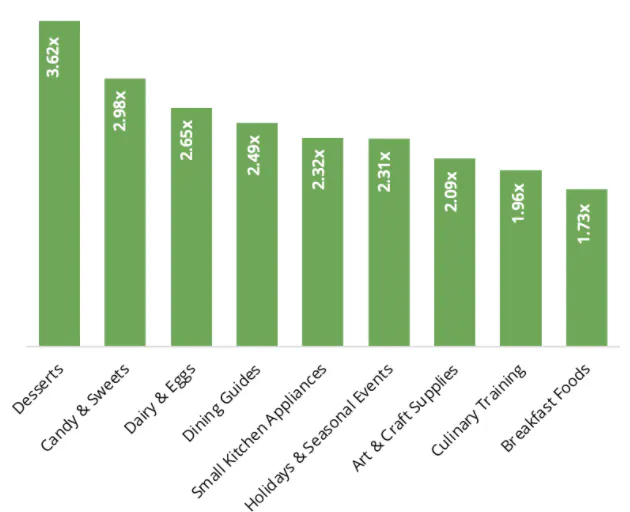

Other Product Categories users are interested in based on the online content they are currently consuming

Average score is always 1. An index value above 1 indicates that a user has x times higher than average interest in that category.

Discover actionable findings that can help refine strategies, tactics, and more

Because real-time interest data can analyze data beyond purchase history and in-store brand preferences, it can produce new, unexpected insights that lead to more effective strategies and tactics.

For example, a Breakfast Foods brand could identify trending interests among their existing and targeted customers and refine campaign strategy to achieve better engagement and response.

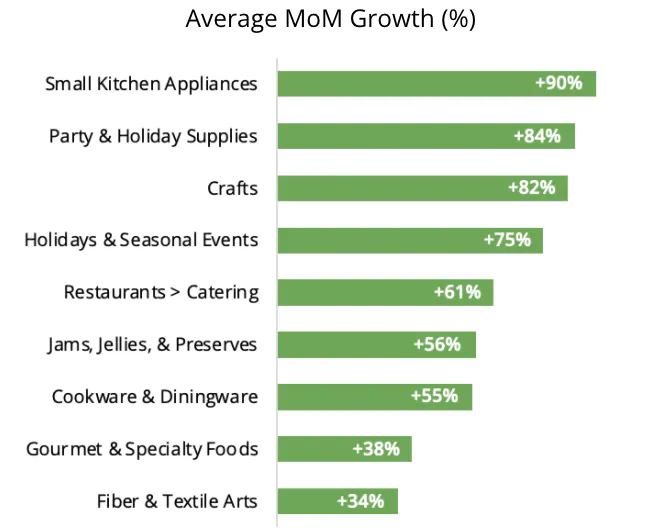

U.S. consumers interested in Baking Goods are more likely to also engage on these topics

Interests that are trending and growing in the US among these users

While traditional CPG industry data analysis relies largely on checkout scanner and panel data, the surge in online shopping is causing retailers to add online consumer data to the mix. However, both datasets fall short of timely insights. The missing link is real-time behavioral data, at scale. Fortunately, ShareThis Curated Data Feed can support predictive analysis that enables CPG retailers, brands, and service providers to optimize outcomes with more confidence thanks to data that yields more context–and as a result, more insight.