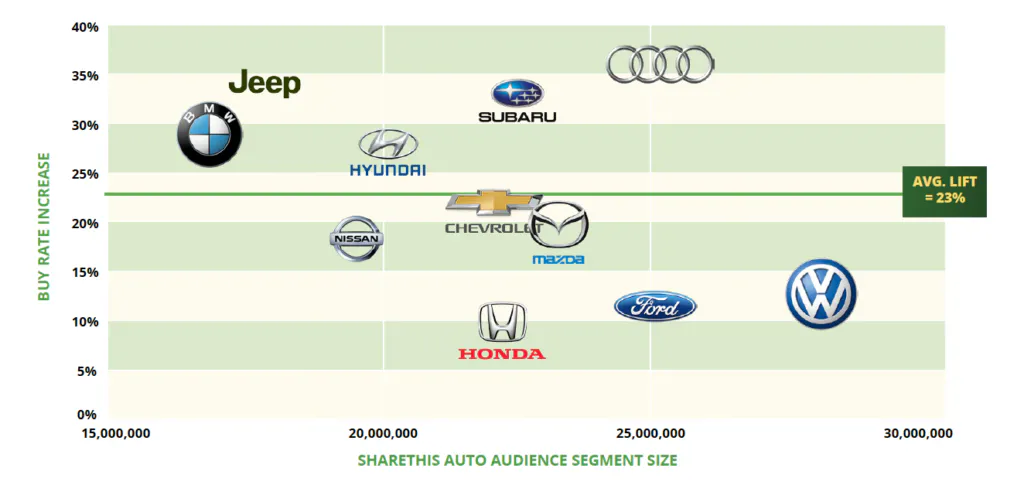

In a first-of-its-kind study, Polk Demand Signals by IHS Markit were used to measure a cross-section of branded ShareThis Auto Audiences to determine if they have a higher likelihood of purchase compared to a national benchmark of US light vehicle sales. Within a 90 day measurement period, ShareThis Auto Audiences reached consumers who were 23% more likely to purchase a new vehicle from among the brands measured. Top performing brands include Audi, BMW, Hyundai, Jeep, and Subaru.

Based on other auto measurement benchmarks, findings above 10% are considered significant. On average, the 11 brands tested more than doubled that benchmark. This shows the segments include above average numbers of buyers who are truly ‘in-market’ and ready to purchase.

This is particularly impressive given that ShareThis Auto Audiences are created to offer scale, delivering an average 25M consumers in the measured segments.

About the Study

ShareThis Auto Audiences were measured using Polk Demand Signals to analyze new car purchase data over a 90 day window from November 2020 through January 2021. The purchase data for ShareThis Auto Audiences was compared to the national purchase data for each respective brand, to show the extent to which our audiences reached consumers who were more likely to buy a new car.

Increase in % of Buyers in ShareThis Audiences vs. National Benchmark

ShareThis Auto Audience Segments

- Acura

- Audi

- Bentley

- BMW

- Buick

- Cadillac

- Chevrolet

- Chrysler

- Citroen

- Dodge

- Ferrari

- Fiat

- Ford

- GM-Daewoo

- Honda

- Hummer

- Hyundai

- Isuzu

- Jaguar

- Jeep

- Kia

- Lamborghini

- Land Rover

- Lexus

- Maserati

- Mazda

- Mercedes-Benz

- Mini

- Mitsubushi

- Nissan

- Peugeot

- Porsche

- Rolls-Royce

- SEAT

- Subaru

- Suzuku

- Toyota

- Vauxhall-Opel

- Volkswagen

- Volvo

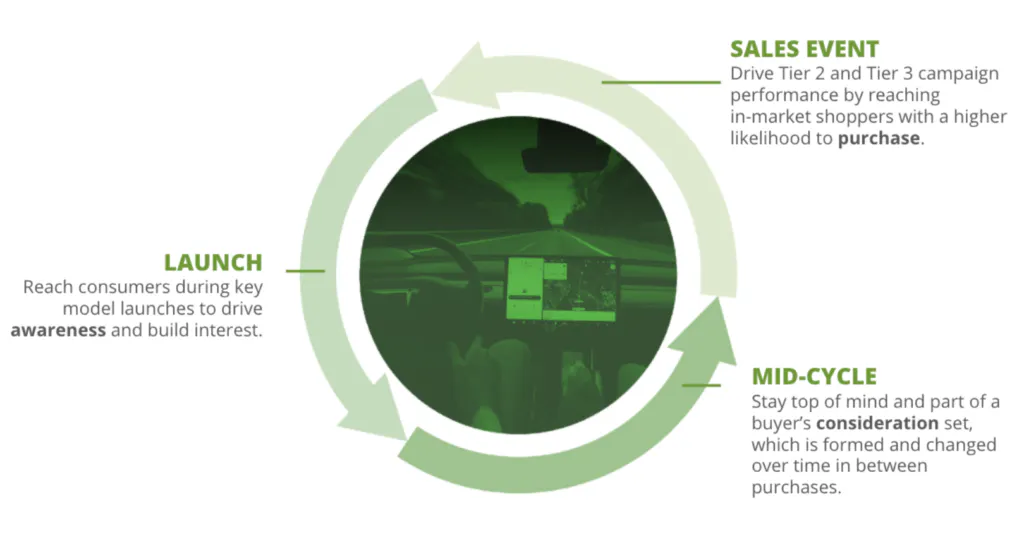

Leverage ShareThis Auto Audiences Throughout the Model Lifecycle

ShareThis Auto Audiences offer a high-scale solution for reaching interested and in-market car buyers. These Auto Audiences are designed to reach consumers based on a broader definition of interest, so brands can also leverage Auto Audiences to reach buyers who aren’t in the market now, but will be eventually, to drive awareness and consideration.

ShareThis Auto Insights Reveal Key Priorities for Car Buyers

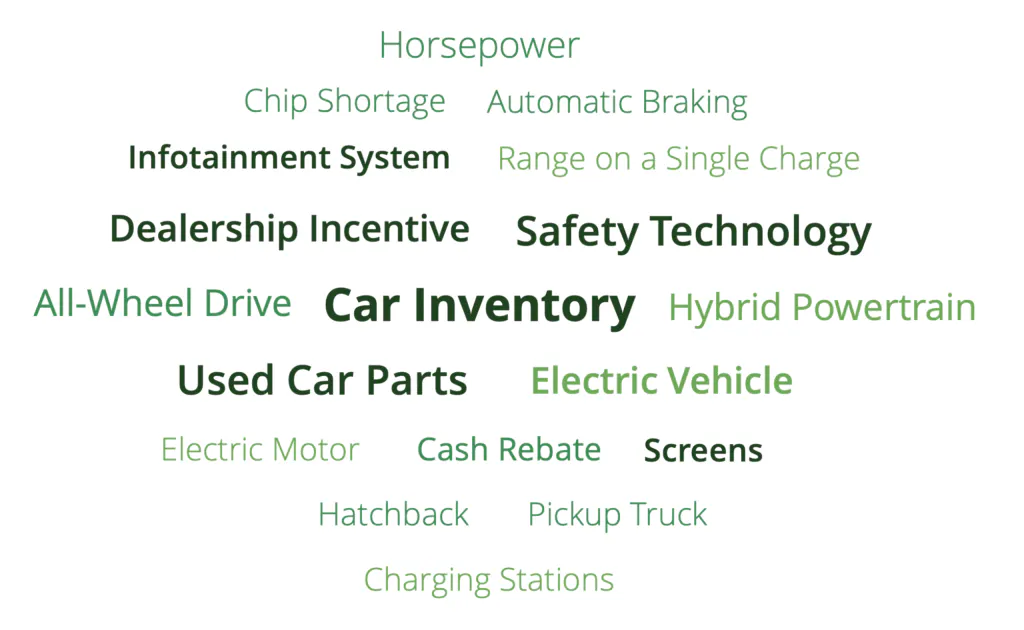

ShareThis has been closely monitoring consumer interest in Auto throughout the last year, and while consumer demand and interest has returned to pre-pandemic levels, there are now supply issues for both new and used cars. Chip shortages have made it harder for new car deliveries to keep up with demand, while strong demand for used cars is pushing prices up.

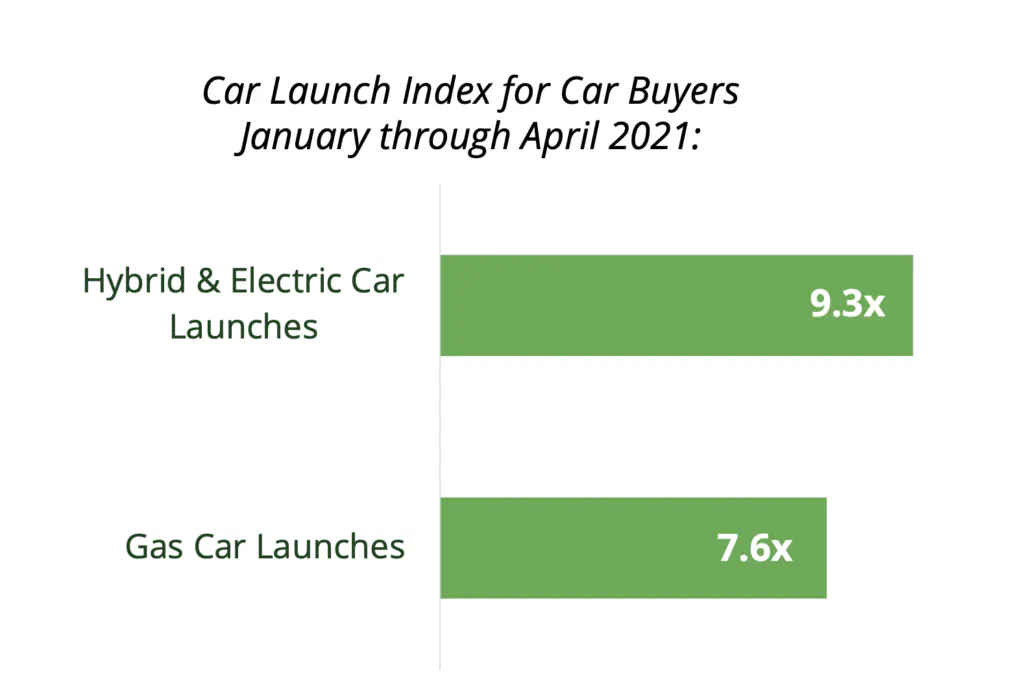

For consumers who are in the market for a new car, ShareThis data reveals strong interest in electric cars. Taking a look at car launch engagement for the first four months of 2021, car buyers were 9.3 times more likely than the average ShareThis user to be interested in hybrid car launches, but only 7.6 times more likely than ShareThis users to be interested in gas car launches, demonstrating an affinity toward new eco-friendly cars.

Based on key search terms, in-market buyers are not only concerned about car inventory levels, but also interested in finding a car that is eco-friendly and has all the ‘bells and whistles’ of your typical gas car.

Most Searched Keywords by an Audience Engaging With Auto

Contact us if you’d like information on ShareThis Auto Audiences.