From new government spending plans to supply chain interruptions, the financial world has experienced its share of fluctuations in the years since Covid-19 hit the United States. Our data indicates consumers are using this momentum to advocate for big financial changes for themselves individually as well as for the population at large.

As we look at what ShareThis data reveals about financial and political trends, consider which government spending concerns are important to you. Do you see your goals being reflected in the data trends below?

Employee Strikes

October 2021 became known as “Striketober” as many employees went on strike to advocate for themselves. Through the weeks of the initial COVID-19 shutdowns and the adjustments that have followed, many Americans have taken a closer look at their working situations. They want changes to policy that will improve their quality of life, and Striketober brought that into focus.

Our data shows engagement with strikes and unions increased 77% in the last year. Many large companies had to face this issue head-on in the last quarter of 2021, including companies like John Deere and Kellogg’s and nurses at healthcare giant Kaiser Permanente. And that’s showing in the data! We expect this interest in strikes and unions to continue based on what we’re seeing from the ShareThis audience.

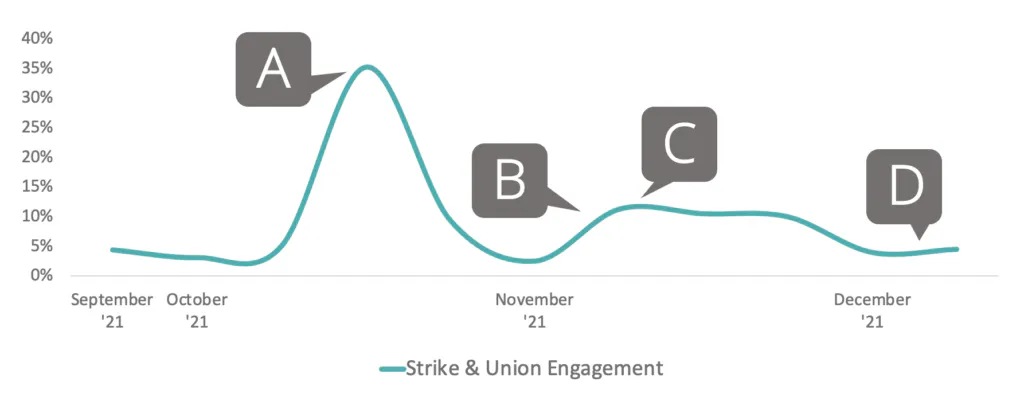

Strike & Union Engagement by a US Audience (%):

A: John Deere workers (UAW), IATSE, and Kellogg’s strikes gain national attention as companies fail to address issues with pay, reduced/stripped benefits, and unsafe working conditions; “Striketober” coined as employees at other companies also begin to strike for improved conditions.

B: Kaiser Permanente nurses schedule a strike for Nov. 15 if agreement can’t be reached. UAW rejects an offer from John Deere.

C: UAW accepts John Deere’s offer that includes guaranteed pay raises and cost-of-living adjustments; nurses accept offer from Kaiser Permanente that includes new language for HCW and patient protection, maintaining benefits, and career development opportunities.

D: Kellogg’s union agrees to new deal and ends the strike. The agreement will create a pathway for newer employees to more quickly gain “legacy” status and the wage and benefits threshold that comes with it. The agreement also includes guaranteed raises and no plant closures through October 2026.

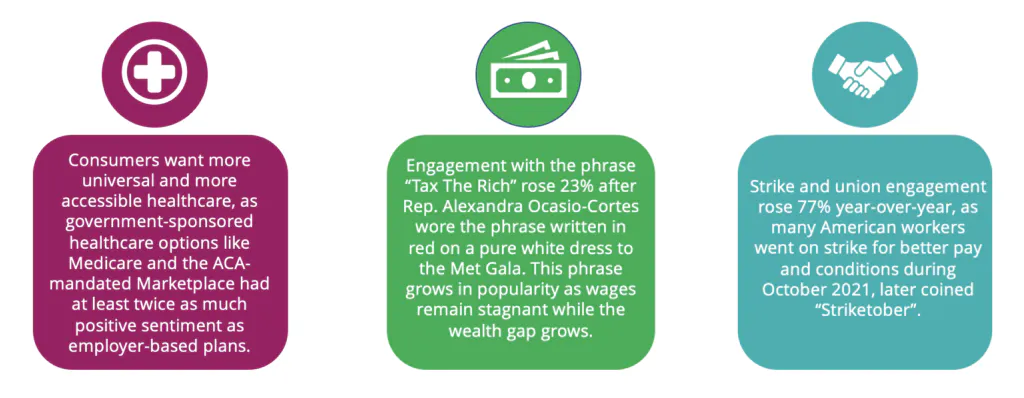

Government-Sponsored Healthcare

During a global pandemic, healthcare is an essential topic. Americans want to be sure they will be cared for if they are sick or injured without experiencing major financial setbacks. Hospital stays are notoriously expensive, and they have gone up in 2021 as we have dealt with high rates of hospitalization due to COVID-19 surges.

With all of that, this year’s ShareThis data indicates that Americans have strong preferences in terms of the healthcare options available to them. Many users are leaning away from the more traditional model of employment-based insurance toward a government-sponsored healthcare model.

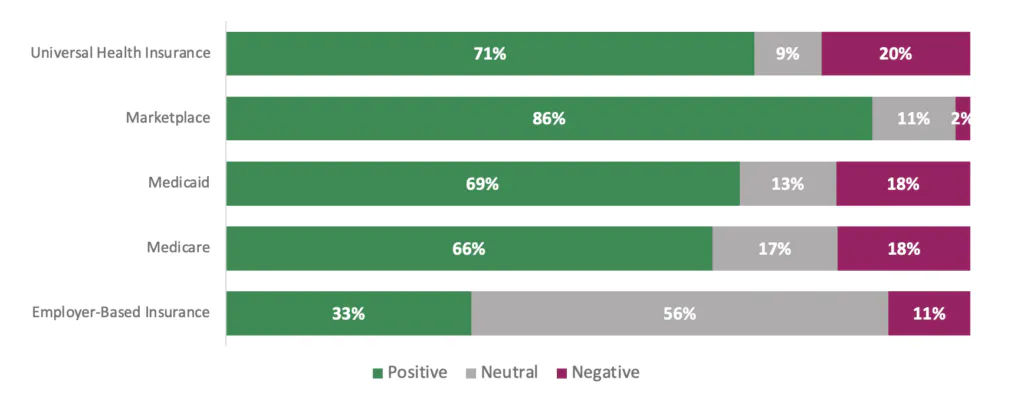

- Universal health insurance surprisingly has 71% positive sentiment, which signifies strong support.

- Marketplace insurance, in which users shop for what they need and make decisions based on what is available, has the most positive sentiment at 86%, with only 2% feeling negatively about the option.

- Users are overwhelmingly neutral about employer-based insurance, with only 33% positive sentiment and 56% neutral sentiment.

Could all of this hint that the population is more willing than we think to try predominantly government-sponsored health insurance?

Sentiment for Health Insurance Options by a US Heath Insurance Audience (%):

Student Loan Forgiveness

During his campaign, U.S. President Joe Biden made many promises to the American public about finances, and our data shows Americans are hoping he delivers. A major area of concern is that of government forgiveness for student loans. Over the past few decades, educational expenses have increased while wages have not grown at the same pace, and many loan-holders believe this difference needs to be made up by student loan forgiveness.

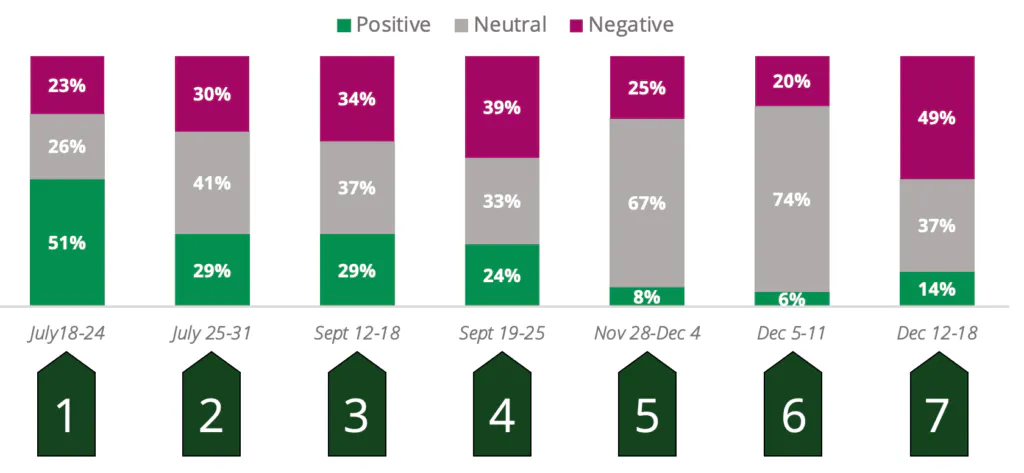

President Biden made this plan a major component of his platform, and Americans are watching closely. Online trends show that from week to week, the president’s approval rating is tied to news about forgiving student debt. As discussions go back and forth about whether Biden has the authority to forgive loans and if he is making the right decisions, his approval rating follows.

While data indicates his approval rating was high at the end of July—when $500 million of student loan debt had been forgiven—in mid-December, a flurry of think-pieces and social media posts questioning if he will be effective in his plan to restart repayments in February has led to increased negative sentiment.

Sentiment for President Joe Biden by a US Student Loan Audience (%):

1: President Biden has forgiven over $500 million in student debt at this point.

2: Discussion of whether President Biden has the authority to cancel student loans; Biden does not say he does.

3: President Biden forgives loans for borrowers who were misled by educational institutions; advocates push for a more fair income based repayment.

4: Senator Elizabeth Warren states that President Biden has the authority to cancel student loan debt.

5: White House announces that student loan repayments will begin on Feb. 1, 2022.

6: President Biden doubles down on restarting the repayments as announced.

7: Articles and social media posts begin to surface stating that voters feel betrayed by Biden’s handling of student loans.

Renters Insurance and Small Businesses

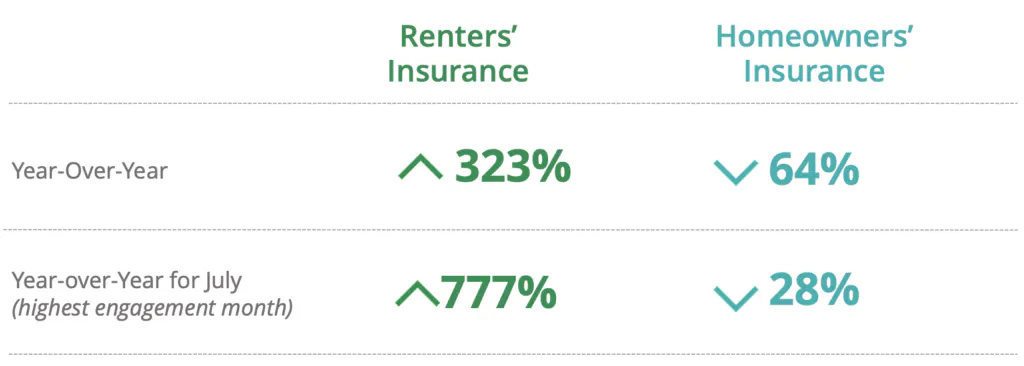

As financial security has wobbled during the pandemic, more and more Americans are renting homes instead of buying them. Interest in renters insurance has increased by hundreds of percentage points, maxing out at an increase of 777% year over year in July of 2021. Meanwhile, homeowners insurance has undergone a decrease in online engagement, going down 64% overall.

Recent Change in Online Engagement with Renters’ Insurance and Homeowners’ Insurance (%):

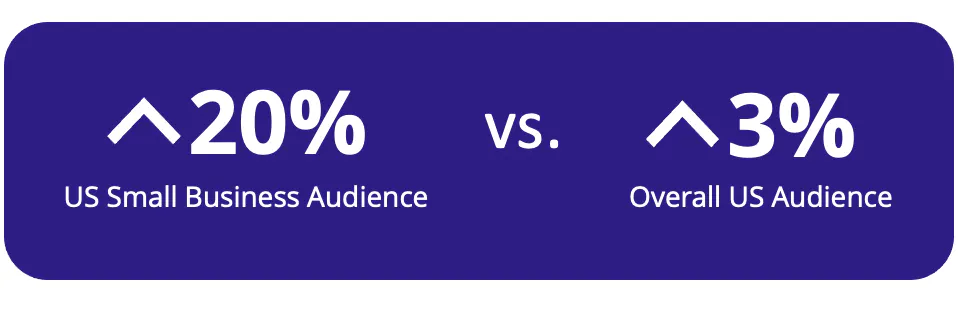

Small business owners have also felt the pinch of recent changes and are concerned about the next market crash, searching for recession keywords at an increased rate of 20% compared to overall US engagement with recession keywords at 3%. Our data shows small business owners are also searching for more information about small business loans and financing at an increase of 52% week over week.

Increased Engagement Week-Over-Week With Recession Keywords by US Overall and Small Business Audiences:

Increased Engagement Week-Over-Week With Small Business Loans & Financing by US Overall and Small Business Audiences:

Tax the Rich

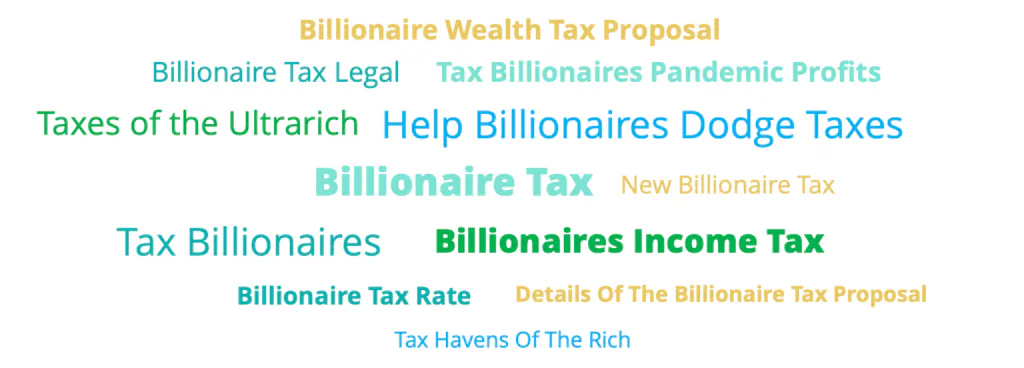

Congress member Alexandria Ocasio-Cortez of the House of Representatives sparked both outrage and admiration when she appeared at the 2021 Met Gala in a white dress with “Tax the Rich” painted on the train in bright red. ShareThis data indicates interest in taxing the wealthy as a policy strategy increased 23% the week following her controversial gown, using keywords like “billionaire tax” and “taxes of the ultrarich.” Clearly Ocasio-Cortez’s gown made its mark!

Most Searched Keywords by a US Tax the Rich Audience:

Financial Trends Help Predict the Future

We’re in a dynamic era of change, and this is reflected in our government spending and personal choices about where we want our dollars to go. Keeping an eye on financial trends can provide an important window into where we are headed to be able to better plan for the future.

Contact us if you’d like to use our data on current financial trends for your audience.