自從COVID-19大流行首次襲擊我們以來,我們已經到了一年的嚴峻周年紀念日,我們問自己:我們知道它倖存下來的零售業嗎?隨著大流行病的繼續,我們能否在未來幾個月內期待什麼?幸運的是,我們的數據掌握著這些答案。

應該祝賀零售業,因為他們的策略使購物保持活力。他們轉而調整他們的送貨和店內策略,以保持安全,並支持我們都呆在家裡,包括:

線上參與度同比增長 (%):

<strong>+2716%</strong>

店內和路邊皮卡

+242%

"非接觸式"購物和送貨體驗

因此, 與2020年3月相比,零售參與度僅下降了4%。 有幾個購物類別,特別是目前幫助推動零售增長與自己令人印象深刻的同比增長:

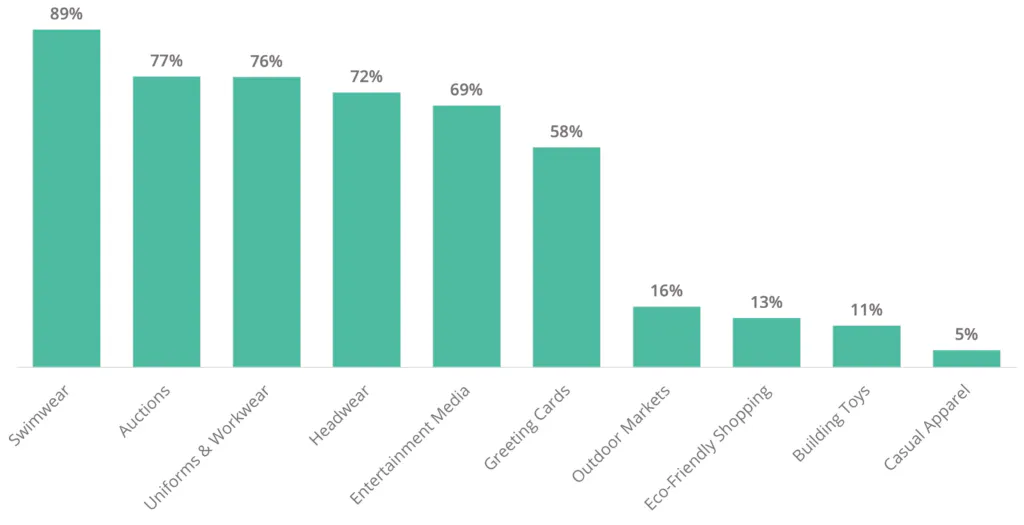

購物類別參與度同比增加 (%):

無論夏季大流行是否結束,在戶外聚會都比去年更安全,因此泳裝、頭飾和戶外市場等戶外購物類別的表現都比去年好。我們還看到隨著制服和工作服的增長,更多的工作場所開放,而娛樂和賀卡向我們表明,人們仍然優先考慮家庭娛樂,並保持距離的聯繫。

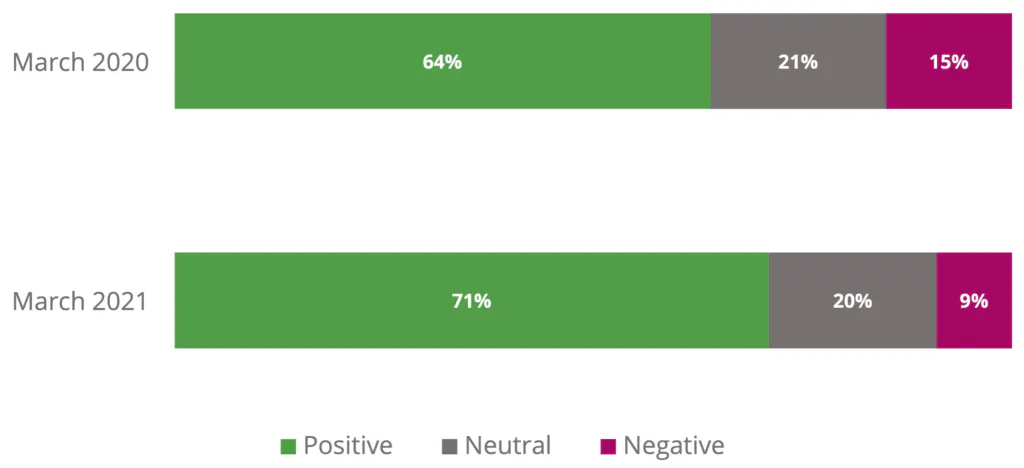

大流行零售的另一個成功案例是在當地購物。社區已經走到一起,以"我們在一起"的心態促進地方經濟。 自去年三月以來,本地購物的正面情緒上升了7%,本地及手工製品的搜索量亦上升百分之十九

本地購物情緒 (%):

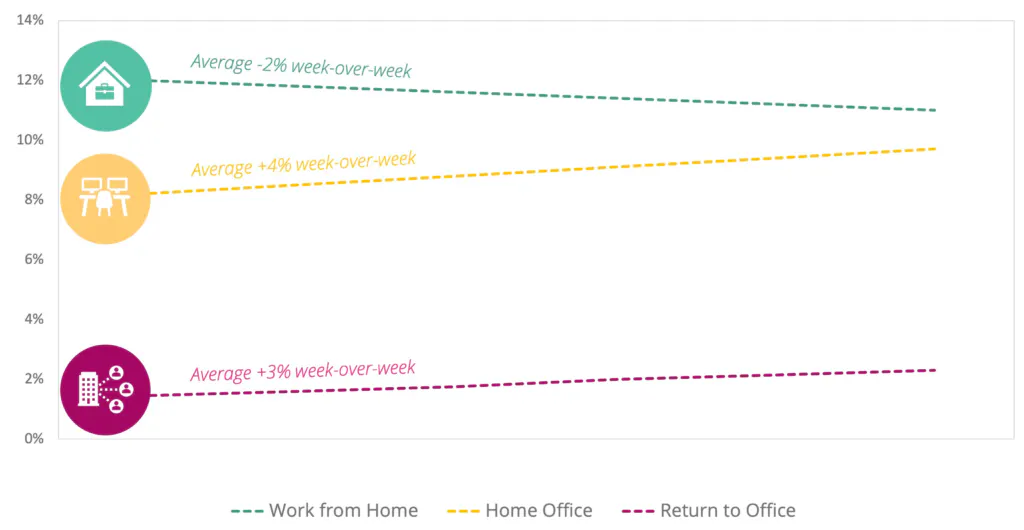

在技術零售方面,我們正在密切關注從在家工作到重返辦公室的轉變。我們發現,儘管圍繞"回到辦公室"這一主題的社會信號在增加,但進展非常緩慢,儘管圍繞在家工作這一話題的參與度正在迅速下降。有趣的是,與家庭辦公室主題的在線參與度持續增加,反映出員工可以平衡在家和辦公室的時間,甚至大流行后更靈活的心態。過去一年表現良好的公司開始認識到,遠端工作對員工來說同樣具有生產力,因此家庭辦公空間將繼續是重中之重。支援這一理論的是數據顯示, 全球臺式計算機的參與度同比增長了15%。

根據搜索和股票的最新趨勢,預計主題的參與度增長(%):

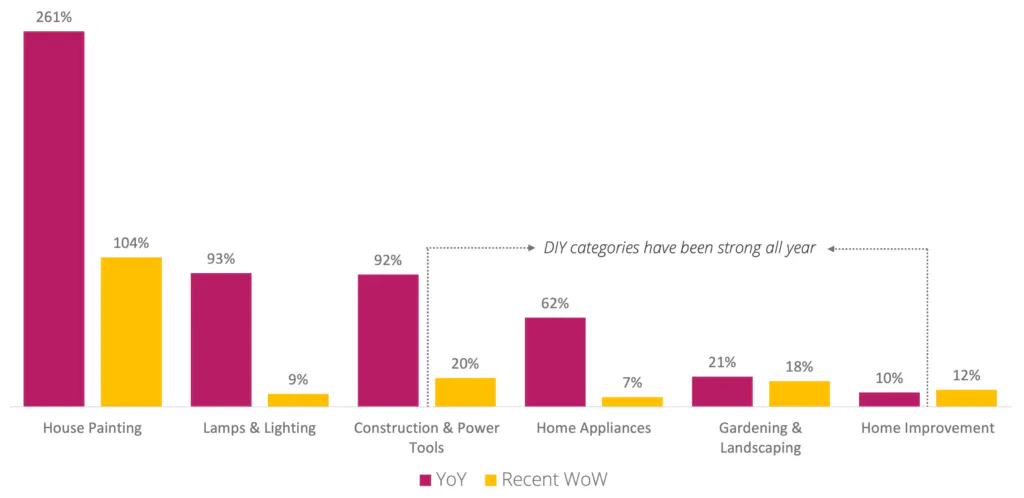

在住宅方面,零售業肯定會受到房地產市場的推動。上市量已經同比增長了9%,並以平均每週5%的速度穩步增長,這意味著將再次出現春夏人潮。相關類別也沒有放緩, 房屋粉刷同比增長261%, 平均每周增長104%。事實上,只要人們學習新技能或警惕邀請陌生人回家,「自己做」的類別一年到頭都很強:自去年3月以來 ,建築和電動工具的社會信號增加了92%, 平均每周增長20%,自冬季以來,家庭裝修總體穩步攀升,平均每周增長12%。

家庭類別參與度逐年增加,每周增加 (%):

那麼,零售業會恢復正常嗎?與美容相關的零售業可能掌握著答案。網上參與度開始上升,包括與美容和美容專業人士約會(平均每周約24%)、整容手術(平均每周增長22%)和時裝系列(每周平均增長8%)。畢竟,我們看到未來的活動正在被宣傳——例如,最近圍繞音樂會和音樂節(每週約66%)和活動清單(每週16%)的熱鬧氣氛有所增長,這表明對夏季抗擊病毒的進展持樂觀態度。 無論哪種方式,我們已經到了人們不太關注基本購買的階段

零售業正處在從大流行中復甦的邊緣,但這個零售新時代將取決於它的靈活性。隨著客戶按照自己的節奏進行重新調整,可定製、面向社區和安全的購物體驗將比以往更加重要,零售商應給予他們空間和支援。

我們預測:

家庭將是最快的零售類別, 以恢復到大流行前的參與水準

技術零售將保持其目前的參與水平相當長一段時間

美容和時尚零售將是最慢的回報, 但夏季的月份是特別有希望的

如果您想使用我們的資料追蹤零售,請聯絡我們,因為它在不斷發展。